Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

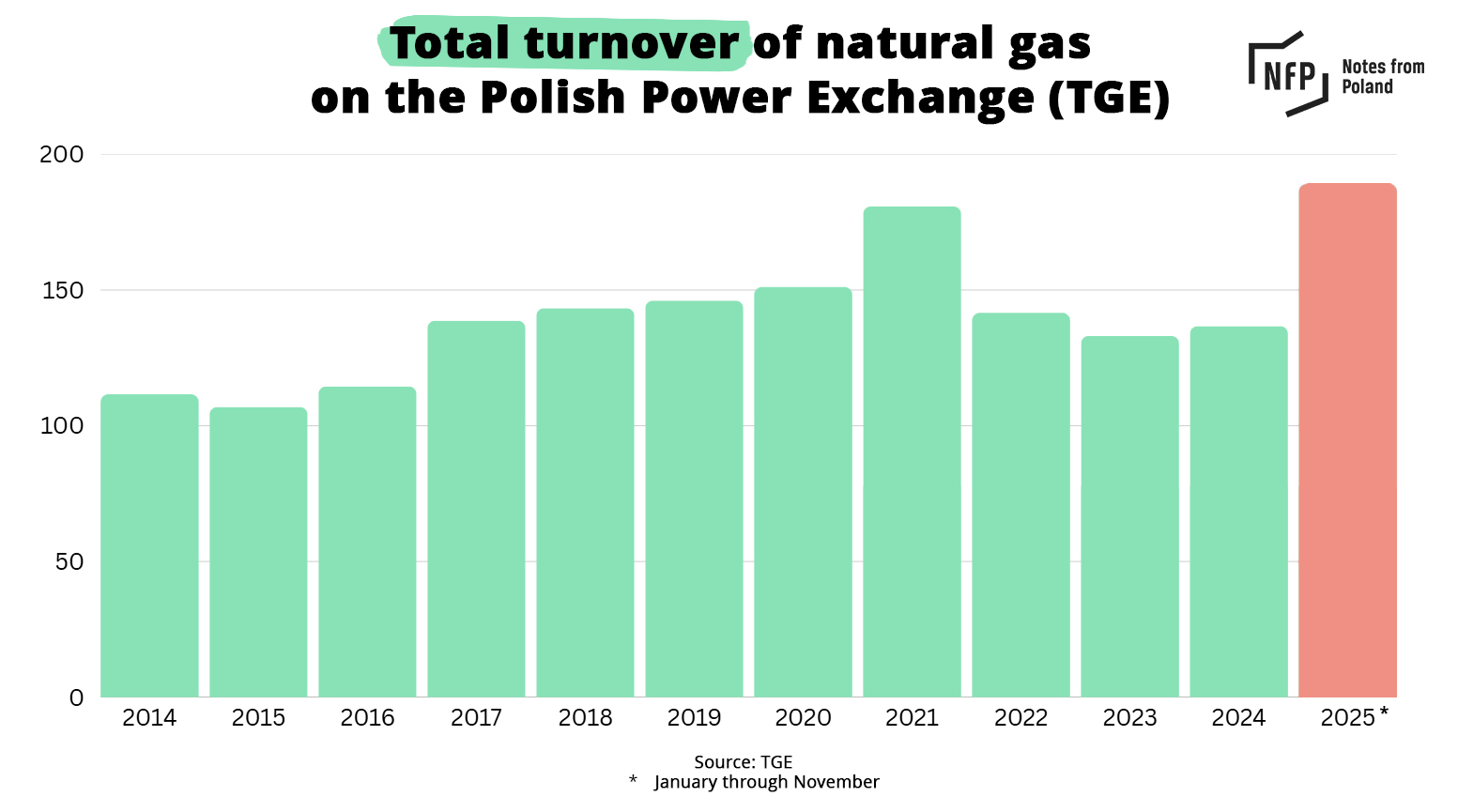

A record amount of natural gas has been traded in Poland this year, surpassing the levels seen before Russia’s full-scale invasion of Ukraine and the energy crisis that followed.

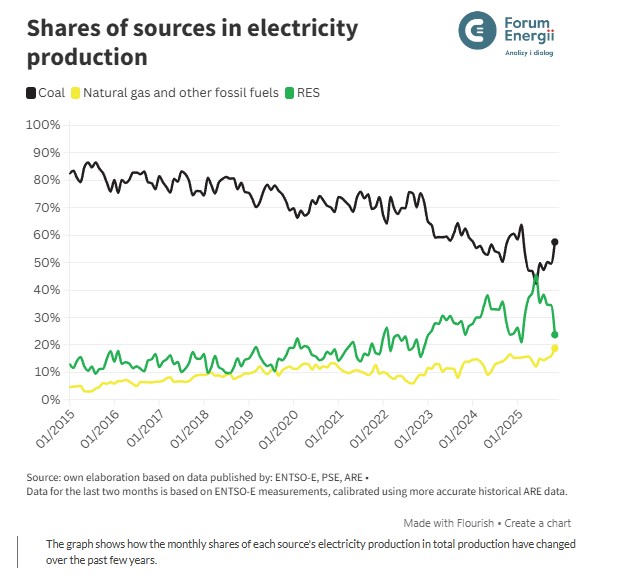

The share of gas in Poland’s energy mix has also reached a record level, accounting for almost a fifth of electricity production last month, as the country continues its move away from coal.

By the end of November, 189.3 terawatt hours (TWh) of natural gas had been traded this year on the Polish Power Exchange (TGE), Poland’s only commodities exchange, which trades nearly two-thirds of Poland’s gas consumption. That surpassed the previous full-year annual record of 180.8 TWh set in 2021.

In February of the following year, Russia launched its full-scale invasion of Ukraine, prompting Poland to accelerate its plans to stop buying Russian gas – which in 2021 accounted for 58% of imports – and sparking a broader energy crisis.

In April 2022, Russia then decided to cut off gas supplies to Poland entirely, after Warsaw refused to comply with Moscow’s demands to pay in rubles.

Poland had already long been preparing to move away from Russian gas, through the liquefied natural gas (LNG) terminal in Świnojście that opened in 2015 and the Baltic Pipe, which since September 2022 has brought gas from Norway via Denmark.

Since 2022, Poland has ramped up LNG imports, with a record number of cargoes arriving in Świnojście this year, covering around 40% of national gas demand.

Construction recently began on a second LNG terminal, to be located in Gdańsk, that will open in 2028 with an annual capacity of 6.1 billion cubic meters (bcm). That will boost the 8.3 bcm capacity of Świnoujście.

In September, Poland’s gas transmission operator, Gaz-System, announced that it had begun gauging market interest from neighbouring countries in LNG imports, with the aim of assessing whether to build a second floating terminal in Gdańsk alongside the one already under construction.

A shipment of American liquefied natural gas that arrived yesterday was the 400th since Poland opened its LNG terminal in Świnoujście almost exactly a decade ago.

It has received a record number of deliveries this year, supplying 40% of Poland's gas needs https://t.co/ZcBxA7eNjI

— Notes from Poland 🇵🇱 (@notesfrompoland) November 17, 2025

Higher imports have increased the role of gas, which is seen as a transition fuel used to bridge the shift from higher-polluting fuels such as coal (which still generates most of Poland’s electricity) and oil towards a planned energy mix mainly reliant on nuclear and renewables.

In November 2025, gas-fired power plants and cogeneration plants produced 2.8 TWh of electricity, 12.4% more than a year earlier, according to Forum Energii, a think tank. That meant they accounted for 18.8% of Poland’s energy mix, the highest share in history.

Prices on both the spot and futures markets fell slightly in November compared to the previous month, to 158.38 zloty (€37.44) per megawatt hour (MWh) and 147.37 zloty per MWh, respectively.

Source: Forum Energii

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Gaz System press materials

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.