Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

By Olivier Sorgho

In July this year, Feerum, a little-known Polish grain storage company, achieved a milestone after it made an investment of roughly 130 million zloty (€30.2 million) along the Suez Canal in Egypt. The Chojnów-based firm announced a partnership with local business East Port Said Development to build a plant for grain silo components and help improve Egypt’s food security.

Not only was this the first such manufacturing project in Egypt by a Polish firm, it also went against the flow of sluggish foreign investment in the country’s economy.

Although Feerum’s investment was dwarfed by the United Arab Emirates’ earlier $35 billion deal to develop a stretch of Egypt’s coastline for tourism, such large-scale individual transactions are rare. In fact, foreign money flowing into Egypt fell by 13.7% last year, mirroring a global trend of dwindling overseas investment.

According to the UN Trade and Development (UNCTAD) 2024 investment report, wars and trade spats have added strain to a slowing global economy, lowering companies’ appetites to spend abroad.

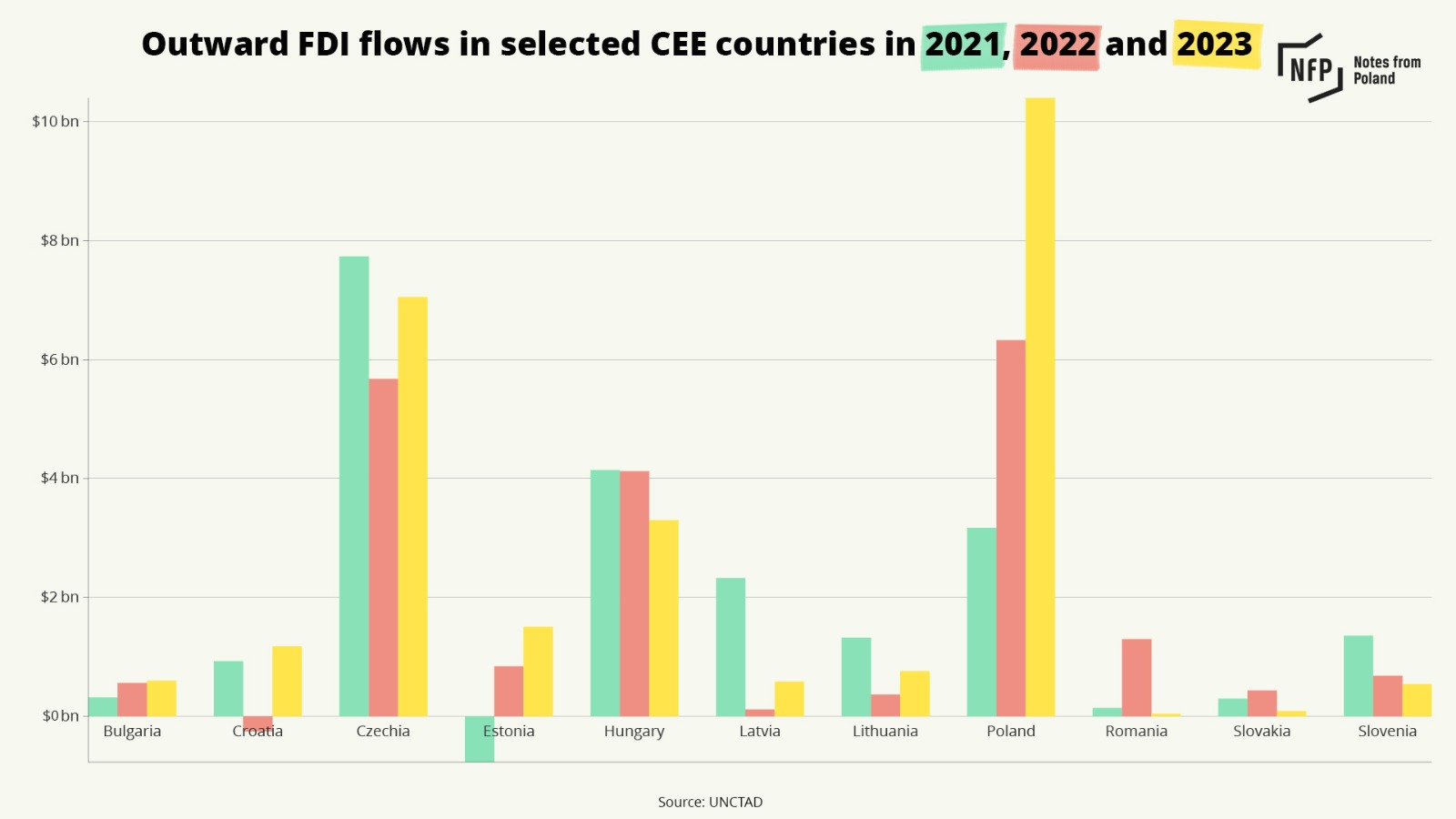

Yet Poland is bucking this trend. Last year, the country saw a 64.5% increase in foreign direct investment (FDI) outflows, leading to its second highest ever tally of $10.4 billion and a third consecutive year of outward FDI growth. Its share of global exports was a record 1.5% in 2023, overtaking countries such as Brazil, Turkey and Saudi Arabia.

Since the turn of the century, major players like state energy giant Orlen, mining corporation KGHM, IT firm Asseco, and pharmaceutical company Polpharma have been growing their operations outside of Poland.

Now, more than 30 years after the transition to the free market, more firms possess the competitive edge and necessary financial firepower to expand abroad, explains Marian Gorynia, former rector at the Poznań University of Economics and Business.

“The position and role of the Polish economy and its companies are undeniably growing,” he says. “However, this does not mean that Poland has suddenly grown into an undisputed economic power.”

Polish state energy giant Orlen will enter the Austrian market after agreeing a deal that will see it take control of 266 petrol stations currently operating under the Turmöl brand.

“This is a great day for the Polish economy,” says CEO @DanielObajtek https://t.co/1TSx3ws28c

— Notes from Poland 🇵🇱 (@notesfrompoland) July 4, 2023

Despite a 30.4% year-on-year drop in 2023, Germany’s outward FDI flows were still almost ten times higher than Poland’s. France’s, which grew by 37.1% across the same period, were nearly seven times larger.

Polish cross-border investments have fluctuated rather than grown steadily in the past decade, but three years of consecutive increases have positioned Poland as an investment leader in Central and Eastern Europe (CEE), signalling a positive trajectory.

Innovation in financial technology

Take the financial technology (fintech) sector, led by the innovative BLIK mobile payment system. Operated by Polish Payment Standard, an alliance of Poland’s six largest banks, BLIK allows instant money transfers between users through a six-digit code sent to their smartphone.

In September, it became available to customers of one of Slovakia’s largest banks. It received in October clearance to operate in Romania and has plans for expansion into other markets.

“The development of BLIK in Slovakia opens us to other European Union countries,” says Dariusz Mazurkiewicz, the CEO of Polish Payment Standard. “By launching operations in the euro currency, we are creating a scalable solution that can be transferred to Western European markets.”

Polish mobile payment system BLIK has moved forward with its international expansion after becoming available in Slovakia.

The service, which is used by millions of Poles, also has plans to expand to Romania https://t.co/GthzrHNIjq

— Notes from Poland 🇵🇱 (@notesfrompoland) September 3, 2024

Meanwhile, Poland’s largest bank, PKO BP, which has branches in Germany, the Czech Republic, Slovakia, and Ukraine through Kredobank, in October announced plans to enter nine other countries, mostly in Western Europe.

Kamil Piechowski of PKO BP highlights the “nearshoring” trend – the outsourcing of business processes to nearby, often bordering countries – as a good opportunity for Polish businesses to scale up their activity with overseas clients.

“The sectors that will benefit from this are primarily those that are already driving Polish exports,” he explains. “These include transport machinery and industrial goods, but also Polish furniture, cosmetics, clothing, footwear, food products and carpentry. ”

A retail sector that looks eastwards

Some firms are already investing in boosting production or distribution channels to cater for an increase in orders from abroad. The logistics partner of Polish clothing giant LPP said in June that it would expand its warehouse space by 50% by the end of next year to boost deliveries to nearly 40 global markets.

Meanwhile, fashion retailer Answear has started operating in Italy, its first market in Western Europe and its 12th overall. Both LPP and footwear brand CCC gained market share in Ukraine at a time when fast fashion leaders such as Spain’s Inditex and Sweden’s H&M took longer to re-open stores that had been closed following Russia’s invasion of the country.

Indeed, Polish retail companies are doing well in Ukraine, explains Sylwia Jaśkiewicz, an analyst at brokerage firm BOŚ SA. “They probably have a higher risk tolerance and better knowledge of the local market,” she continues. “The Ukrainian market is probably more important for Polish companies than for Western companies due to the scale of their operations.”

Investment in green energy

The war in Ukraine has also impacted Europe’s energy market, prompting countries, like Poland, that were reliant on Russian energy to diversify and invest in not only green energy but also in oil, gas and coal.

That process has accelerated the expansion of Orlen, Poland’s state energy giant, which grew its network of international petrol stations by nearly a third year-on-year in 2023, after a buying spree in Austria, Germany, Slovakia and Hungary.

In June, it acquired an additional 19.5% stake in a Norwegian gas field from Equinor Energy, and in September it said it would explore growing its renewable energy footprint in Lithuania, including offshore assets and green hydrogen production.

According to a ranking by Fortune magazine, Orlen is already the 44th largest company in Europe and is the only firm in the CEE region to make the top 50.

Polish state energy giant Orlen has been ranked as 44th largest company in Europe by @FortuneMagazine.

It is the only firm in the region between Germany and Russia to reach the top 50, and also recorded the largest annual revenue growth among those firms https://t.co/GbeyGVFuP7

— Notes from Poland 🇵🇱 (@notesfrompoland) November 9, 2023

Smaller renewable energy firms are also expanding, in Europe and beyond. Sixty-three Polish firms unveiled 81 “greenfield”, or “from scratch,” investment projects last year for a total value of $2.36 billion, a year-on-year rise of 2.6%.

Those were largely in renewable energy and mostly in the United States, Montenegro, Jordan, Romania and Kazakhstan. That is a sign of a growing tendency in setting sights beyond the CEE region, where Polish firms have tended to invest.

Respect Energy, which produces and trades wind and solar energy among other green alternatives, this year entered Germany and is eyeing France, Italy, the UK and Spain in 2025. It is also part of a consortium of firms that plans to build the world’s largest offshore wind farm off the coast of Australia.

Hynfra, a Polish company focused on green hydrogen, last year established a firm with a local partner in Jordan to build a green ammonia plant in the country. In March, it signed a similar deal in Mauritania, after the government-affiliated Polish Investment and Trade Agency (PAIH) helped initiate talks.

Foreign acquisitions are driving growth

Piotr Soroczyński, chief economist at the Polish Chamber of Commerce (KIG), suggests that, while Poland’s previous government supported the expansion of major state firms like Orlen and played a part in improving the export of goods and services, more could be done to help smaller companies allocate capital abroad.

Polish travel group eSky has agreed a deal to buy Thomas Cook, the world’s oldest travel brand, from its Chinese owner for a reported £30 million https://t.co/wFyo7BW38z

— Notes from Poland 🇵🇱 (@notesfrompoland) September 5, 2024

Buying firms or their assets is a quicker route to growth abroad than competing with local players through exports, especially in markets like Germany where consumers tend to favour a nationally recognised brand, he adds.

Polish firms are getting bolder in buying their peers in Western Europe and the United States, says Artur Wilk, mergers and acquisitions manager in consultancy firm Navigator Capital. That is partially driven by many firms that were established after 1989 undergoing a period of ownership succession, he continues.

“A new generation of owners – young, open-minded and well-educated (often in top Western universities) are taking the reins in the companies and want to fulfil their ambitions of building regional champions.”

A September PwC study found that expanding into new sectors or foreign markets is a top priority for the heirs of Polish family businesses.

Polish delivery giant InPost has completed its acquisition of two businesses belonging to British logistics firm Menzies for over £60m (308m zloty) as it continues its rapid international expansion https://t.co/1I5Z4JvKSS

— Notes from Poland 🇵🇱 (@notesfrompoland) October 16, 2024

Successful acquisitions like Polish chemical group Qemetica’s purchase of factories in the Netherlands and the United States from American giant PPG for around 1.2 billion zloty, and parcel locker firm InPost’s international ventures, are encouraging other firms to head out west, Wilk adds.

InPost, which pioneered the use of parcel lockers in Poland and is present in France, Italy and the Benelux, in October bought the remaining 70% of British logistics firm Menzies, as it rapidly expands in the UK.

After reaching a dominant position in Poland, its service has also proven popular abroad, particularly in inflationary times, because it is cheaper for consumers and retailers than traditional to-door parcel deliveries, says Erste Group analyst Krzysztof Kawa.

After Polish flight search engine group eSky bought in September the financially struggling Thomas Cook from China’s Fosun, British newspaper The Telegraph predicted an incoming “wave of Polish takeovers” in the UK.

It referenced Poland’s relatively low taxes, as well as the country’s economic and stock market growth outpacing rival economies and unlocking cash for its companies’ overseas investments, and a highly-skilled workforce with a returning diaspora increasingly finding opportunities at home.

"The wave of Polish takeovers is just getting started," writes the @Telegraph after Poland's eSky bought travel brand Thomas Cook.

"The UK spends a lot of time worrying about competition from Germany and France, but we may be looking in the wrong place" https://t.co/jjzhVhxQ8w

— Notes from Poland 🇵🇱 (@notesfrompoland) September 8, 2024

“After the COVID-19 pandemic, our business recovered much faster than our competitors,” says Łukasz Habaj, eSky’s founder and CEO. While Thomas Cook’s former owner sold the firm to reduce the risk of financial losses, he expects it to turn profitable this year.

Habaj says that it will take up to two years of investments for those profits to become significant, but is confident that the brand, with its huge customer base, will help his company transition into a travel package firm and expand further in Western Europe.

“In a difficult time in the global economy, we [Poland] are daring to try and manage situations from which others are pulling out of,” says Soroczyński, the chief economist at KIG. He suggests that Poles may be particularly adept at navigating challenging scenarios, due to the country’s history of dealing with social and economic crises.

Indeed, a 2023 study found that, when compared with French and German firms, Polish companies had higher corporate resilience and financial flexibility during the global financial crisis and the COVID-19 pandemic.

“Reducing costs and risks, along with building scale and gaining access to technology, are all motivating Polish companies’ expansion,” says Gorynia, the former rector at the Poznań University of Economics and Business. “Operating solely in Poland may be risky in a situation of political and military turbulence.”

Artur Miernik, a people consulting partner at consultancy EY Poland, also points to Polish labour market dynamics, like rising wages, as spurring expansion. Firms surveyed by EY in September referenced the quality of Polish workers, in particular their managerial and linguistic skills, and knowledge of specific business areas, as other key drivers.

“Shrinking access to talent in Poland, combined with rising labour costs, means that competition for the best employees will only increase, which may increase the desire to develop in other markets as well,” he explains.

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Jakub Zerdzicki/Pexels