Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Poland’s Żabka Group, which runs Europe’s largest chain of convenience stores, has debuted on the Warsaw Stock Exchange (GPW) in one of Europe’s biggest listings this year.

The value of the initial public offering (IPO) on Thursday reached 6.45 billion zloty (€1.5 billion) – making it the 4th biggest debut in the GPW’s history and putting the value of the entire company at 21.5 billion zloty (€5 billion).

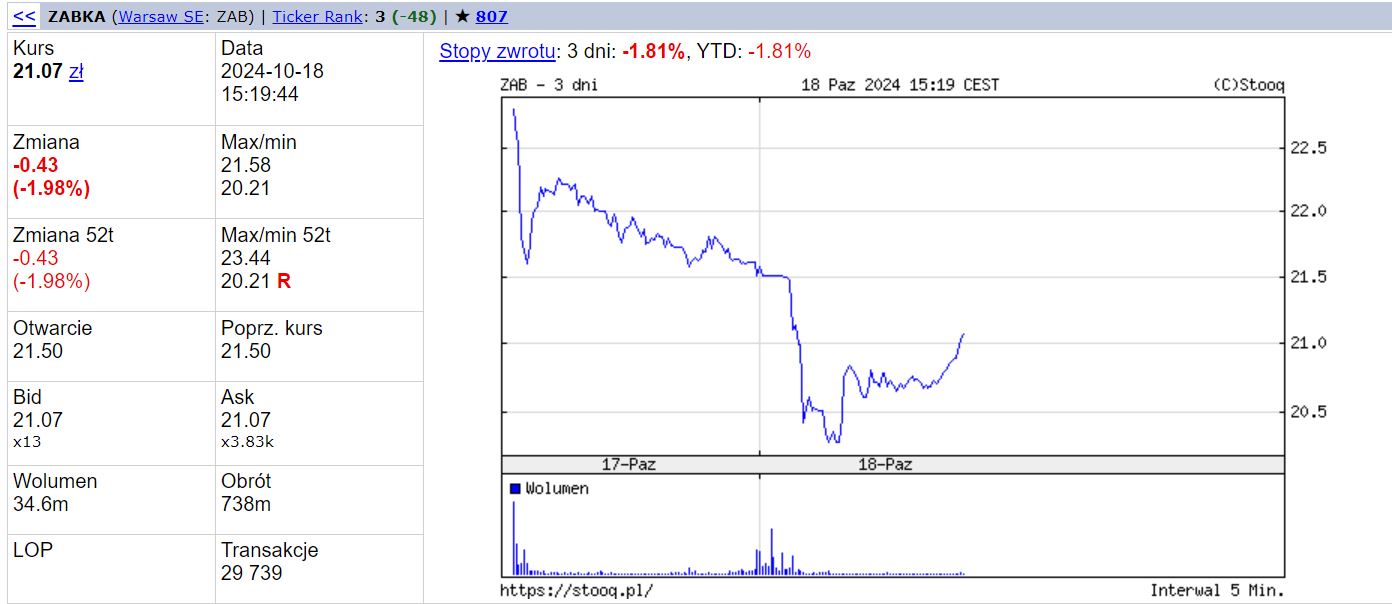

However, the opening disappointed many analysts, after the firm’s share price failed to make anticipated gains on its opening day yesterday and then fell further today.

Shares initially rose 7% following their debut at 9:15 a.m on Thursday. However, they quickly lost those gains and ended the day at 21.5 zloty a share, the IPO listing price. Many analysts had expected a double-digit rise. Today, Żabka shares remained below the IPO level and by 3 p.m. were down 2% on the day.

“[The market] hoped for double-digit growth; meanwhile, the opening was weaker than these expectations,” Konrad Ryczko, an analyst and broker at DM BOŚ, told broadcaster TVN.

Although Żabka’s debut disappointed some analysts, the company’s management and the stock exchange described the IPO with enthusiasm.

“The listing of the Żabka Group on the stock exchange is a strategic step and milestone, indeed a leap in the history of our organisation,” said the company’s CEO, Tomasz Suchański, as quoted by HandelExtra news service.

“This is the largest offering on the Polish stock exchange in years, and also the largest in Europe in the second half of 2024,” said Tomasz Bardziłowski, the head of the GPW, quoted by the Rzeczpospolita daily. “We want to attract new issuers to the Warsaw Stock Exchange and Żabka’s debut may help to do so.”

The IPO was the fourth biggest in the history of the GPW, after e-commerce giant Allegro (9.2 billion zloty), state-owned insurer PZU (8.1 billion zloty) and state-owned bank PKO BP (7.9 billion zloty), reports TVN.

When Allegro debuted, it saw gains of 50% at the opening. Despite initial enthusiasm, however, the company’s shares started to fall several months after the IPO and are currently trading about 50% below the levels seen in the first day on GPW.

Because of the high demand for Żabka’s shares in the IPO, individual investors, who took 5% of the offering, were only able to receive 10% of the shares they subscribed for, reports financial news service Money.pl.

Polish e-commerce giant Allegro has expanded its brand to a third country in the region after launching a retail platform in Slovakia.

It did the same in the Czech Republic last year, with plans for Hungary, Slovenia and Croatia in the pipeline https://t.co/uMkhuSNDNk

— Notes from Poland 🇵🇱 (@notesfrompoland) March 19, 2024

No new shares were issued during the IPO and all of the funds raised will go to the current shareholders, including leading shareholder US private equity firm CVC Capital Partners. The company said it does not plan to issue any new shares.

The offer included up to 45 million overallotment shares. If the overallotment option is fully exercised, the value of the IPO will increase to 7.42 billion zloty.

Żabka is the dominant player in Poland’s grocery store market, with around 10,500 locations across the country run by some 8,600 franchisees. The firm has also recently sought to expand abroad, opening its first stores in Romania earlier this year.

Polish convenience store chain Żabka has opened an outlet in Romania, its first one abroad.

The firm, which is already the largest convenience store chain in Central and Eastern Europe, hopes to have 200 outlets in Romania by the end of this year https://t.co/2ylB7bXEh9

— Notes from Poland 🇵🇱 (@notesfrompoland) May 15, 2024

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Żabka press materials

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.