By Wojciech Jakóbik

The Baltic Pipe, which began pumping Norwegian gas to Poland via Denmark in October, is the culmination of an idea almost as old as democratic Poland.

Gas supplies from Norway will increase Poland’s security and contribute to European efforts to become independent from Russian energy. As usual, though, the devil is in the detail.

Third time lucky for the Baltic Pipe

The plan to import gas from Norway was first conceived by Prime Minister Jan Olszewski’s government in 1991, following Poland’s first fully free parliamentary elections, with then deputy interior minister Piotr Naimski as its driving force. At the time, the country imported all its gas from Russia.

However, the short duration of Olszewski’s government, which was controversially brought down after only six months, prevented the fulfilment of the concept.

After this episode, Poland decided to instead concentrate on building the Yamal Pipeline – bringing Russian gas to Germany through Poland – in order to make money on transmission and to receive gas supplies in return for the Polish government’s financial commitment to its construction. That resulted in Poland remaining 100% dependent on Russian supplies.

Poland is taking over Gazprom’s assets in the country, meaning the Russian firm’s share in the Polish section of the Yamal gas pipeline

"We're doing all we can to counteract Russia’s aggression and eliminate Russian capital and influence," says a minister https://t.co/iQ9So8LX6g

— Notes from Poland 🇵🇱 (@notesfrompoland) November 15, 2022

The government of Jerzy Buzek – who counted Naimski among his advisors – returned to the idea of Norwegian gas supplies, signing an agreement for the construction of a pipeline in 2001. However, his government was voted out of office later that year, and the new administration, led by Leszek Miller, abandoned the plans, claiming that they were not economically viable.

The diversification of gas supplies returned to the table under Kazimierz Marcinkiewicz’s short-lived government in 2006, which discussed the Skanled project to connect to Sweden and Denmark.

Yet this was abandoned for economic reasons in 2009, with Donald Tusk’s new administration preferring another diversification projected proposed by President Lech Kaczyński and his advisor, Naimski: the liquefied natural gas (LNG) terminal in Świnoujście, which was completed in 2015.

The next government, under Beata Szydło, then returned to the Baltic Pipe project for a third time, with Naimski again featuring, this time in the role of government plenipotentiary for strategic energy infrastructure – and this time finally managing to bring the idea to fruition

The Baltic Pipe today

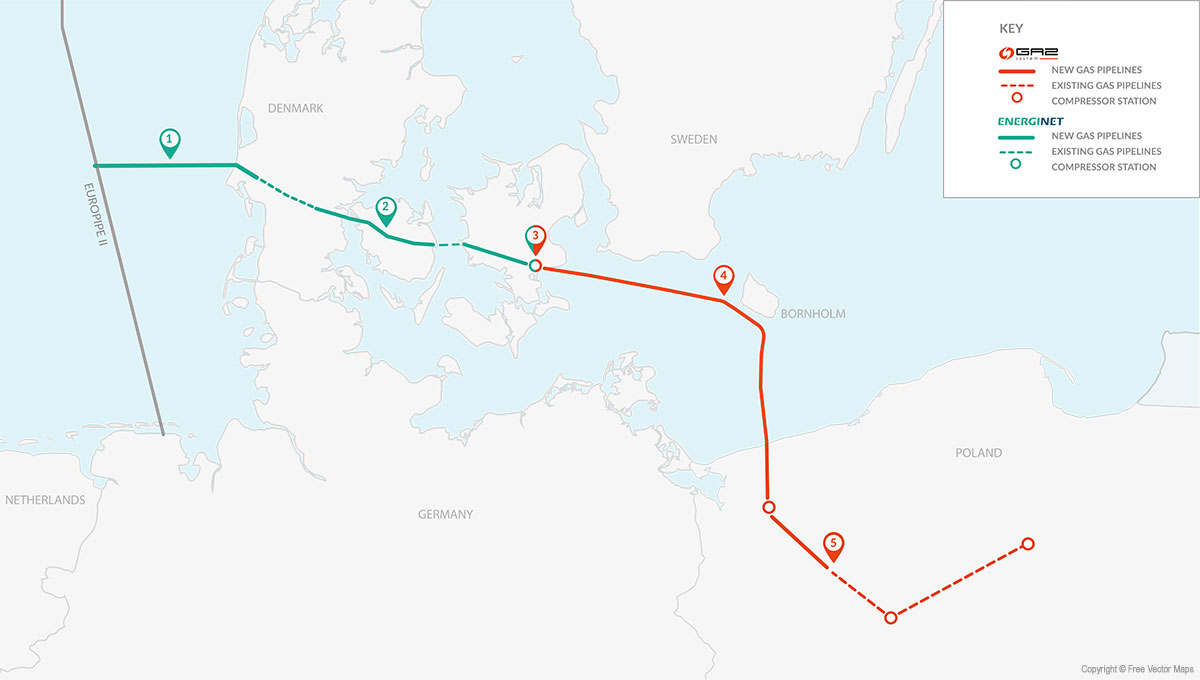

The latest edition of the Baltic Pipe links to the Europipe II gas pipeline, Which itself transmits gas from Norway to Germany. It is not directly connected to the deposits, but to the Kårstø facility in Norway, which is used by various recipients. This is an important detail for the next stage of work.

The operators Poland and Denmark’s gas transmissions systems, Gaz-System and Energinet.dk, each have half of the shares in the Baltic Pipe venture. The pipeline has a final annual capacity of 10 billion cubic metres (bcm), representing half the annual gas usage in Poland, which reached 19 bcm in 2021.

The Baltic Pipe’s route

The project was justified by both economic arguments – with constant, long-term supply it would provide a more stable price than LNG imports – as well as a geopolitical one: finally ending reliance on gas from Russia.

The second of those goals – a longstanding aim of the current Polish government but criticised by the circles that had scrapped the second attempt at a Baltic Pipe in 2001 – was vindicated this year following Russia’s invasion of Ukraine.

In spring, Russia stopped supplying gas to Poland completely, but the country’s security was not threatened since it had already planned to abandon Russian gas by the end of the year anyway.

As well as reducing gas demand by an estimated 17% this year, Poland has replaced Russian supplies by maximising LNG imports through Świnoujście and gas connections with neighbouring countries, as well as now receiving the first supplies through the Baltic Pipe.

To sum up, it looks as if the pipe from Norway along with other sources will give Poland the gas it needs for late 2022 and early 2023. But what about beyond that?

The power of the Baltic Pipe

The main line from Norway via Denmark to Poland is ready and apparently has the gas needed to fill it. In 2022, this will amount to 2.5-3 bcm, as capacity has been limited by construction delays in the Danish section caused by disputes over environmental permits

PGNiG declares that it will receive 6.5 bcm in 2023 and 7.7 billion in 2024. The gas is to come from the company’s own extraction – it owns over 60 licences on the Norwegian shelf, ultimately totalling 4 bcm per year – as well as agreements with Lotos, Aker BP, Orsted and Equinor.

Some of these contracts were signed in the midst of the energy crisis and thus may not satisfy the economic requirements initially set out for the Baltic Pipe, but they have been essential for security of supply. This became the priority because of the obvious threat from the east.

Although this gas pipeline has an annual capacity of some 10 bcm, around 2 bcm must be reserved for third parties in line with EU regulations. PGNiG reserved around 8 from Gaz-System and uses correspondingly less for various reasons – not only difficult economic conditions, but also perhaps the reduced demand signalled by the climate minister.

The verdict on this state of affairs is a mixed one.

The Baltic Pipe opened on time despite the delays in Denmark, giving Poland security of supply in the face of Russian games. However, Norwegian contracts were on the table for several years, but were not signed because at the beginning of the energy crisis in summer 2021 prices might have been expected to fall at any moment. But they did not fall before the Kremlin’s invasion, in fact reaching an all-time high.

Poland was therefore backed into a corner when it signed the latest contract with Equinor. But it was essential for security reasons. The Poles were first in the queue because they had been negotiating for a long time, which was why suggestions spread by Russian trolls in spring 2022, that Germany would overtake them and collect the gas Poland had been counting on, proved to be false.

However, the fact that the Baltic Pipe is not routed directly to Norwegian deposits and that Norway’s Gassco is not involved means that in future there may be competition between clients for gas from this source in the aforementioned Europipe II, from which the Baltic Pipe runs.

But one should note that construction of a gas pipeline directly to Norwegian reserves, bypassing Denmark and by sea through the Denmark Strait, could be several times more expensive as well as entailing longer work for Poland because of the need for additional pressure booster stations.

Connecting to Europipe II, meanwhile, could justify the involvement of Denmark, who would gain a new route allowing them to send gas from their Tyra deposit. What is key is contracting – already done through agreements – as well as an allocation permitting resources to be shared in a way that various recipients are not deprived of gas. Gassco guarantees all companies extracting gas in the country, PGNiG among them, equal access to the infrastructure.

The Baltic Pipe, which began operating three days ago and links Poland to Norway's gas fields, is for now actually supplying gas from Germany, says Norway's system operator.

It will start pumping gas from Norway "some days into October" https://t.co/QLc0nlI5LM

— Notes from Poland 🇵🇱 (@notesfrompoland) October 4, 2022

There is also the option of increasing capacity at Kårstø if clients need more gas. Also helpful will be the joint gas purchases proposed by the European Commission, which, together with the US, has been seeking to secure supplies since autumn 2021, when Brussels and Washington knew that the next stage of Russia’s war against Ukraine was imminent.

And help will come too from cooperation in using the LNG terminals to be opened in Germany in the coming months. Sometimes Poland will import more LNG through Germany, and sometimes Germany might contract something in the surplus capacity of the Baltic Pipe.

End of the Gazprom era

Further diversification of gas supplies will bring about a decline in the demand for gas from Russia. Further down the line, a successful energy transformation thanks to the combination of nuclear energy and renewables in Poland will reduce dependence on this fossil fuel in general.

This means that the Baltic Pipe, as an indispensable piece of the gas security puzzle in Poland and the region, will contribute to the lessening strategic importance of natural gas as a fuel – but that is a long way away.

For now, it will help to wean Europe off Russian gas. This has been admitted even in the Russian media, such as Kommersant, forecasting the closure of this market to Gazprom as a result of the energy crisis. In 2021, Russia still had 40% of the European market. By the time of writing, this figure has fallen to around 7%.

Image credits: Baltic Pipe press materials. Article translated from Polish by Ben Koschalka