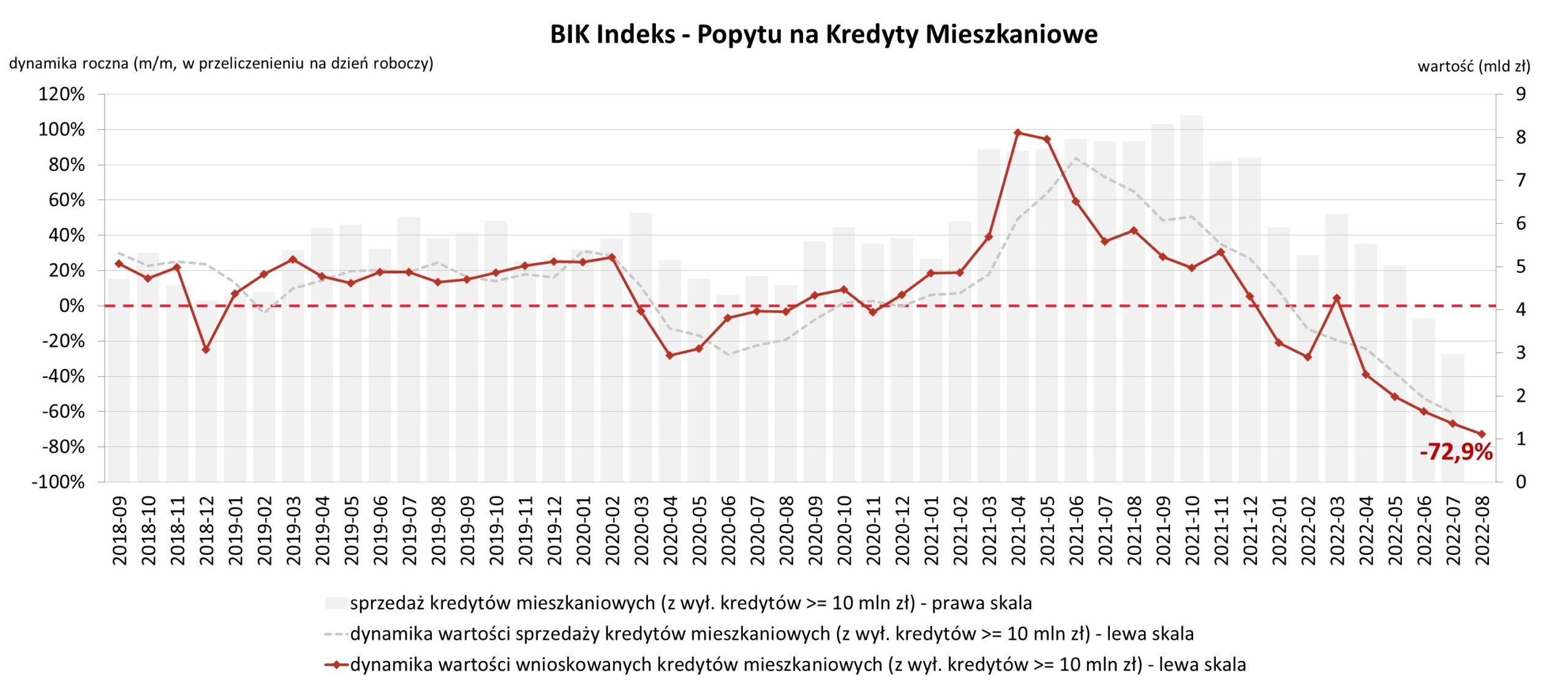

The number of new mortgage applications in Poland fell by nearly 71% year-on-year in August and their total value by 73%, according to data from the Credit Information Bureau (BIK). The development follows repeated hikes in interest rates in response to Poland’s highest inflation in 25 years.

“The August reading of the BIK Housing Loan Demand Index showed that high interest rates, tighter regulatory requirements and fears of the effects of an economic slowdown and even a possible recession have virtually frozen demand for mortgages,” said Waldemar Rogowski, chief analyst at BIK.

BIK also reported that the August value of its index, which measures demand for real estate in Poland, was again the lowest since the institution began collecting the data in January 2008.

“There are still no signs of a rebound from the bottom on the horizon,” said Rogowski. “There are no signs things will get better any time soon.”

BIK mortgage demand index. Red line – dynamic of the value of loans applied for. Grey line – dynamic of the value of loan sales Source: BIK

The number of people applying for mortgages has been falling steadily since April 2021, even before the cycle of interest rate rises began. The average amount of credit applied for also started to fall, which may indicate that borrowers’ capacity to take on loans has decreased.

“In the event of further interest rate rises, demand for mortgages will be further reduced,” said Rogowski. “At the same time, with the increasing burden of rising instalments, a likely scenario is that there will be more interest in credit moratoria in the following months. Borrowers who have not used them so far may opt for a ‘credit holiday’.”

At the end of July, the Polish government introduced so-called “credit holidays”, which allow the suspension of loan repayments for two months per quarter for a maximum of eight months.

Approximately 44% of those eligible have taken advantage of the scheme, which is intended to ease the burden on households having to cope with the costs of loan instalments as interest rates rise to their highest level in almost 20 years.

On Wednesday last week, Poland’s central bank delivered the 11th consecutive interest hike, bringing the cost of debt in Poland to 6.75%, the highest level since 2002. That followed news in August that inflation had unexpectedly risen again to a new 25-year high of 16.1%.

Poland's central bank has hiked interest rates by 25 basis points in a bid to fight continued accelerating inflation.

The 11th consecutive increase, widely expected by economists, brought interest rates to 6.75%, the highest level since Poland joined the European Union pic.twitter.com/X0L99MyEMP

— Notes from Poland 🇵🇱 (@notesfrompoland) September 7, 2022

As a result of the drastic fall in demand for housing, one developer operating in Kraków and Wrocław, Lokum, has halted all new developments and plans to make staff redundant. The company said that its sales fell by more than 50% year-on-year in the first half of 2022.

“For the first time in the history of the company, we have a situation in which we are the ones who do not want to launch new investments, due to the bad situation of customers,” said a representative of the firm’s management board during a results conference, quoted by financial news service Strefa Inwestorów.

The board also stated that it does not foresee reductions in the prices of the apartments on offer as they will not cover the cost of building them. “At the price we are selling apartments at today it would be difficult to build the same apartment right now. This situation can last up to two years.”

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.