Poland’s central bank governor, Adam Glapiński, has been elected by parliament to serve another six-year term with the support of the ruling national-conservative Law and Justice (PiS) party.

Opposition groups, however, have criticised the appointment, accusing Glapiński of failing to prevent inflation soaring to its highlight levels since the 1990s and of being under the political influence of PiS. Some have also questioned whether he is legally entitled to another term.

This evening, 234 members of the 460-seat Sejm, the lower house of parliament, voted in favour of Glapiński’s nomination, including all 228 members of PiS’s parliamentary caucus. The 223 votes against him came from centrist, left-wing and far-right opposition parties.

Glapiński is “a man of enormous knowledge, great competence and experience”, said Michał Wójcik of United Poland (Solidarna Polska), a junior partner in the PiS-led ruling camp. “We value his abilities very highly.”

Borys Budka, head of the parliamentary caucus of Civic Coalition (KO), the largest opposition group, however, accused Glapiński, along with the government, of being “responsible for this disastrous economic policy” that has increased poverty, reports Polsat. “His only qualification is that he knows the PiS chairman.”

Sejm powołał Adama Glapińskiego na prezesa Narodowego Banku Polskiego na drugą kadencję#wieszwięcej pic.twitter.com/kIRZAv2W9Z

— tvp.info 🇵🇱 (@tvp_info) May 12, 2022

Glapiński, who has led the NBP since 2016, is a longstanding associate of PiS party leader Jaroslaw Kaczynski. The evening before today’s vote, Glapiński was pictured visiting PiS headquarters in Warsaw, where the party was holding a meeting.

That visit by the nominally independent central bank chief sparked criticism from the opposition. “It is a sign of subordination and of setting monetary policy in accordance with party demands,” said Krzysztof Gawkowski, deputy leader of The Left (Lewica), quoted by PAP. He called Glapiński PiS’s “political officer”.

PiS spokesman Radosław Fogiel, however, told Wirtualna Polska that it was perfectly understandable for MPs to have wanted to hear from Glapiński before today’s vote, so that they could make an informed decision. He added that other parliamentary parties could have done the same if they wished.

Okazuje się, że to dość ważne, którego konkretnie polityka się zna… #glapiński #NBP #fogiel pic.twitter.com/zMQE1Cz3ZK

— OKO.press (@oko_press) November 4, 2021

The opposition had also cited legal doubts as to whether Glapiński was eligible for a second term, after some lawyers said that his three-month tenure on the NBP’s board of directors in 2016 should be counted as the first of his two terms allowed by law.

But such arguments have been brushed aside by the government, whose spokesman, Piotr Müller, told TVP today that President Andrzej Duda’s chancellery had ordered its own expert opinions, which have “dispelled legal doubts”.

The Sejm’s nomination of Glapiński now passes to Duda, whose responsibility it is to appoint him to the position for a further six years.

Glapiński’s current term, which started in June 2016, began in a relatively calm and prosperous macroeconomic environment, with the longest period of stable rates in the past two decades.

But the second half of his tenure has been marked by the pandemic – during which the NBP’s Monetary Policy Council (MPC) decided to cut interest rates to near-zero levels – and then the war in Ukraine. The crises have helped push inflation to its highest level since 1998.

In response, the MPC has repeatedly hiked interest rates, with this month seeing the eighth consecutive rise, by 75 basis points to 5.25%. Those developments have led to concerns among mortgage holders about their ability to pay.

Poland's central bank has again raised interest rates, as the country experiences its highest inflation this century.

Its benchmark rate rose 75bps today to reach 5.25%, the highest level since 2008. pic.twitter.com/UBmSo0hOKJ

— Notes from Poland 🇵🇱 (@notesfrompoland) May 5, 2022

While inflation is rising quickly in various parts of the world, Poland last year recorded the highest level in the EU. Its current rates are also among the bloc’s highest. The government and Glapiński have blamed the current price rises on the effects of the war in Ukraine.

Economists, however, say that Russia’s actions are only partly to blame. They also warn that raising rates will not be enough to stifle inflation, especially given the government’s expansionary fiscal policy.

While additional pension payments, tax cuts and other handouts “mitigate the effects of price increases and strengthen household incomes…at the same time it contributes to the fact that it is difficult to curb consumer demand, which is the main purpose of raising interest rates”, says Bank Millennium’s chief economist, Grzegorz Maliszewski, quoted by Rzeczpospolita.

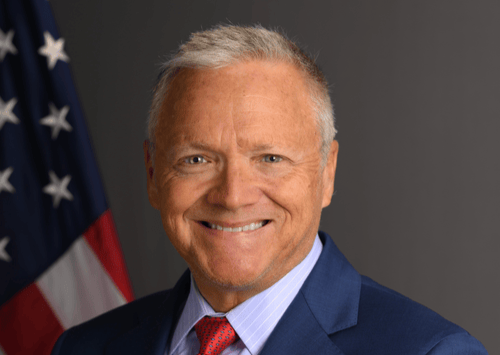

Main image credit: Kuba Atys / Agencja Wyborcza

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.