By Marcin Lewandowski

Cyberpunk 2077 was supposed to change the market. Eight years in the making, repeatedly delayed, the game was anticipated in a way seldom seen in the industry. Its story, depth and graphics were expected to set a new standard.

It is hardly surprising that the game’s Polish producer, CD Projekt – already renowned for making The Witcher series – was in the spotlight before the premiere on 10 December. Yet now, after some versions of the game turned out to be full of glitches, the firm is under fire. Having earlier this year become the highest valued company on the Polish stock exchange, its share price has been tumbling.

Yet while CD Projekt has dominated the Polish “gamedev” scene, in its shadow a whole host of other firms have emerged and thrived. Poland has some 440 companies and 480 game premieres a year, according to a recent report by the Polish Agency for Enterprise Development (PARP).

Many of these firms have benefited from the attention brought to Poland’s games industry by CD Projekt; but they have also forged success on their own merits, and often produce games with a distinctly Polish flavour.

“Only Tokyo lists more games firms”

It is telling that PARP’s analysis presents the financial data of other companies separately to CD Projekt, highlighting its dominance of the sector. The presence of the market leader has, however, has helped other companies attract foreign investors to Poland.

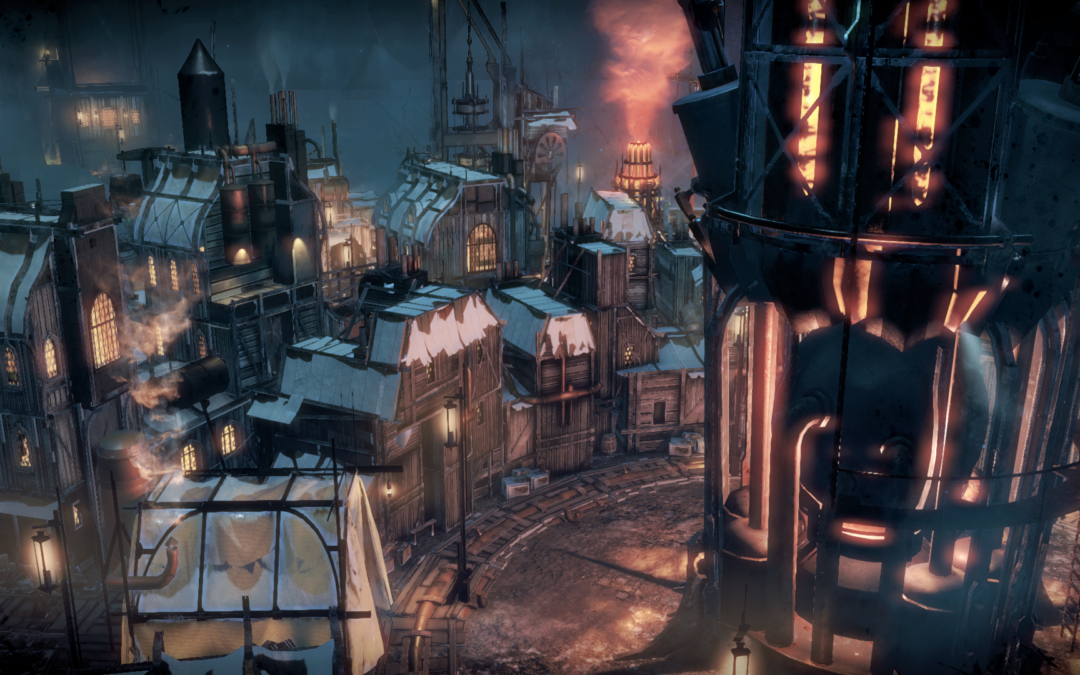

Dariusz Wolak, investor relations manager at Warsaw-based 11 bit studios – which was founded by former CD Projekt staff and has produced well-received games such as This War of Mine and Frostpunk – is optimistic.

“The Warsaw Stock Exchange (GPW) has in recent years become a real hub for game companies,” he says. “The business successes enjoyed by the sector leaders have led to a number of smaller studios using the GPW to raise growth capital.”

Interest has been so great that in spring 2019 the GPW launched a special index for game producers, WIG Games, which has grown 125% since it opened. “The ease of raising capital, also by small studios just getting started, as well as high rates of return from investments have meant that foreign investors are starting to recognise the GPW as a place where they can, or must, look for investment opportunities,” Wolak adds.

This is also confirmed by a series of stock-market debuts. Starward Industries, a still relatively small Kraków-based studio, debuted in August 2020 on NewConnect – the smaller platform of the Polish stock exchange. The company’s shares gained over 300% after the opening, even though the studio is still working on its first game.

“At the moment it is relatively easy to raise capital for new companies, even those only working on their first title,” says Starward Industries’ CEO, Marek Markuszewski. But “good preparation” is required, he adds, including a clear vision for the product, a well-researched market, a complete team, a detailed budget, a production plan and marketing ideas.

Poland's CD Projekt has become the most valuable video game firm in Europe. Its valuation has risen to $8.13 billion, overtaking @Ubisoft.

CD Projekt's much-anticipated @CyberpunkGame is due later this year, after which it will work on a new @witchergame https://t.co/2e6HKz1nRw

— Notes from Poland 🇵🇱 (@notesfrompoland) May 20, 2020

“We already have 44 [games] companies on the…GPW and NewConnect,” says Markuszewski. “Within the next year or so, we can expect to have over fifty. Only the Tokyo stock exchange lists more [such] entities than the Polish one.”

Drawing on Polish culture

As well as the economic factors that make Poland a promising market, local games studios also benefit from their country’s rich cultural reserves, drawing on the literature, history and geography of Poland and its region for inspiration.

CD Projekt’s flagship Witcher series is based on novels by Polish fantasy writer Andrzej Sapkowski. Starward Industries is developing a game inspired by the work of Polish science fiction author Stanisław Lem. Earlier this year, the Different Tales studio released a game whose plot is set in Białowieża Forest and is inspired by real-life conflict between environmental, business and political interests in the UNESCO-listed site.

Even the painful history of the region can be harnessed for games. Gaming Company’s release, Warsaw, describes the history of the 1944 Warsaw uprising against German occupation.

Another title, This War of Mine, developed by 11 bit studios, was inspired by the siege of Sarajevo – a conflict that was much closer to home than some of the wars that provide the backdrop to the story of many western productions.

“We see our heritage as an asset,” says Bartłomiej Piekarski, head of investor relations at Ten Square Games, a developer of mobile games. “[Poland is] a very creative nation, proud of our arts heritage and individualism…[and] is now leading the way in the gaming industry in Europe.”

A review of 'Warsaw', a game set in the 1944 uprising against Nazi German occupation.@CultVultures not only praises the gameplay, but also the opportunity to 'experience and learn about the uprising', a 'historical event rarely touched upon in gaming' https://t.co/We4vM7XGRo

— Notes from Poland 🇵🇱 (@notesfrompoland) October 2, 2019

While it is easier to calculate profits than the benefits from exporting Polish culture, games producers are getting good results in the latter field, to the extent that even politicians like to boast of Poland’s output abroad. In 2011, there was widespread surprise when the then prime minister, Donald Tusk, presented US President Barack Obama with a collector’s edition of The Witcher 2.

“We expect the value of the Polish games market to continue to rise and soon pass 1 billion zloty,” said government spokesman Paweł Graś at the time. This target was reached some time ago. At present, income from the sector has even passed 2 billion zloty, according to this year’s PARP report.

Escaping the middle-income trap

Polish games producers have been looking at global markets from the start. Some 96% of income from the Polish games industry comes from exports, of which as much as half is sent to the United States. The second-largest market is other European Union countries – mainly Germany and France – while for the time being exports to Asia account for just 10%, according to PARP.

“The computer games market is global,” says Wolak of 11 bit studios. “So the place, the country where the development studio operates doesn’t make any difference in terms of the availability of its products for end users.”

Markuszewski, the CEO of Starward Industries, has a similar outlook, although his studio is at a completely different stage of development. “There are companies that have a better position than others,” he says. “But we think that geography has no impact on a privileged position…the only limitations are the creativity of the teams and the quality of the games they produce.”

In fact, it can be a distinct advantage to have a base in Poland. There is a cheaper, but well-educated workforce, for one thing, and the country has a good level of education in scientific subjects. “Poland is a good place for creating games – a relatively high availability of very creative and well-educated staff, and in particular lower operating costs,” says Wolak.

Building a competitive advantage on low pay could lead to the so-called middle-income trap, however. This occurs when a country exhausts its previous sources of competitiveness while long-term drivers, such as innovation, fall behind. According to the European Commission’s innovation scoreboard, Poland is in fourth to last place in the EU.

But, such are the results of the Polish games development industry, that even if salaries draw close to western ones, it will still be able to develop.

Stepping out of the shadows

In May this year, CD Projekt, passed France’s Ubisoft to become the most valuable video game developer in Europe, with a market value of €8 billion at the time. Those fortunes – and valuation – have now waned following the troubled release of Cyberpunk 2077.

But other Polish games firms are still going strong, and snapping at its heels: both PlayWay S.A., a firm founded in 2011 and which listed in 2016, and Ten Square Games have a market capitalisation hovering around the symbolic figure of $1 billion. The sector as a whole is recording a year-on-year growth in income of almost 30%, according to PARP

While CD Projekt has led the way, Poland’s other games developers may now be ready to step out of its shadows.

Translated by Ben Koschalka

Main image credit: Yuniper/Flickr (under CC BY 2.0)