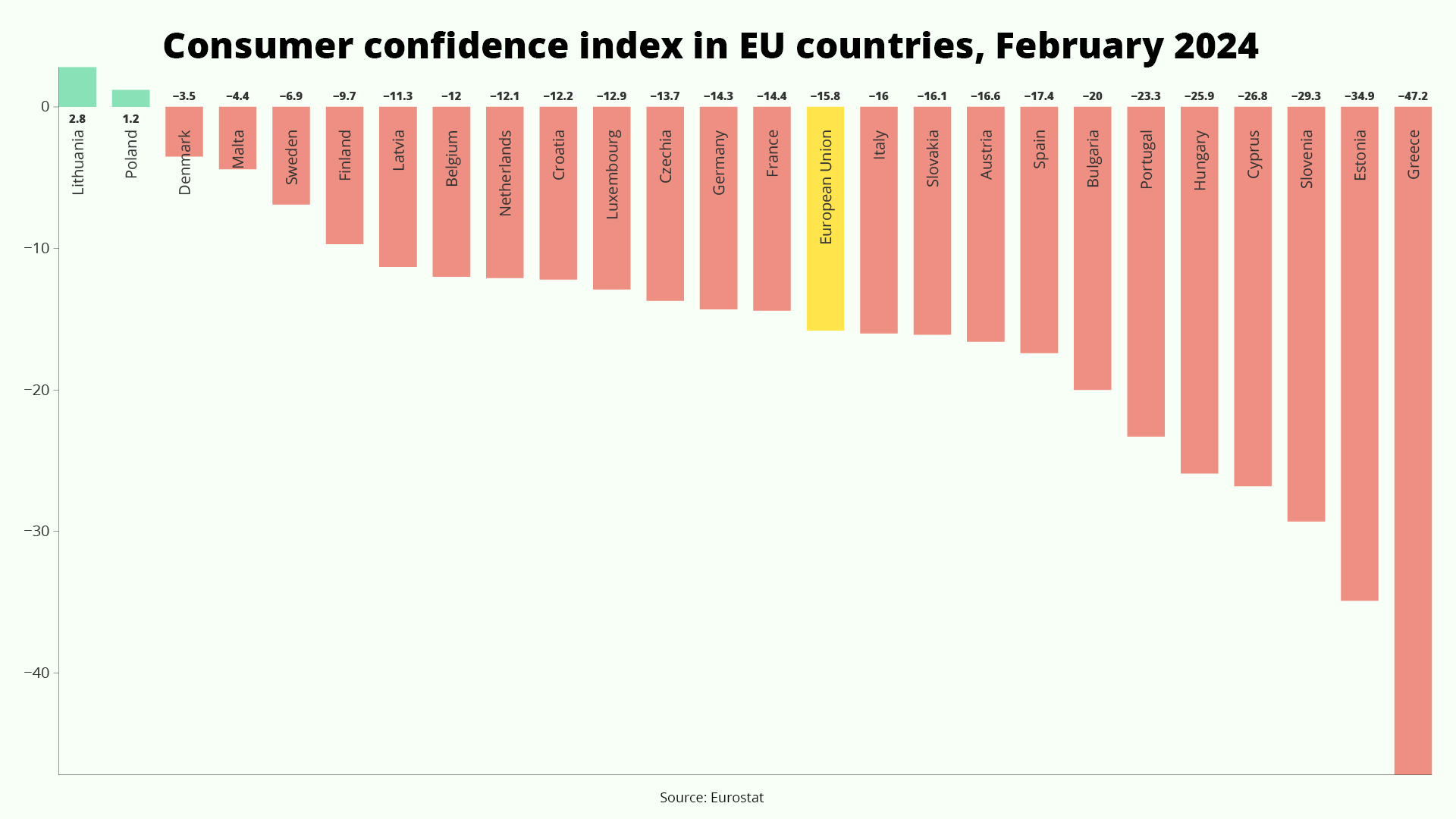

Poland was one of only two European Union countries to record a positive consumer confidence index in February. It has also seen the bloc’s largest rise in confidence over the last year.

Poland’s figure stood at 1.2 in Poland in February, behind only Lithuania (2.8), new data from Eurostat show. The scale runs from -100 to +100, with a score above zero indicating positive sentiment.

By contrast, all remaining member states with data for February recorded negative sentiment. The lowest figures were found in Greece (-47.2), Estonia (-34.9) and Slovenia (-29.3), with the EU as a whole recording a finding of of -15.8.

Poland has also seen the EU’s biggest improvement in the index over the past 12 months, rising by 18.3 points from -17.1 points in March last year. That change has been accompanied by slowing inflation – which fell below 4% in January for the first time in nearly three years – and one of the lowest unemployment levels in the EU

Solid growth in consumer confidence was also recorded by Sweden (up by 14.3 points) and Latvia (up by 12.1 points) while four countries saw declines: Cyprus (down by 8.8 points), Estonia (by 7.6 points), Greece (by 6.1 points) and Italy (by 1.3 points).

The consumer confidence index is based on surveys regarding households’ expected financial situation and their sentiment about the general economic situation. It is used by economics to predict future behaviour of households, including their willingness to spend and save.

“Consumer sentiment indicators show a growing optimism among Poles,” wrote Ignacy Morawski, chief economist at the Puls Biznesu daily, noting that the index has returned to near the level of January 2020, before the crises brought on by the COVID-19 pandemic.

Morawski noted that the faster improvement in sentiment in Poland than in other countries may also be due to the strategy the country has adopted in the face of stubbornly high inflation.

“Poland is one of the few countries that has not made the assumption that high inflation requires fiscal tightening,” he wrote.

Dlaczego nastroje konsumentów w PL🇵🇱 poprawiają się szybciej niż w innych krajach UE?

Odpowiedź leży m. in. w transferach fiskalnych. Polska jako jeden z niewielu krajów nie przyjęła założenia, że wysoka inflacja wymaga zacieśnienia fiskalnego.

Co dalej?https://t.co/34S0FkzPZ7 pic.twitter.com/gU1R6fEMxa— Ignacy Morawski (@iggnacy) February 29, 2024

“Of the many economic indicators I have analysed, it is the increase in fiscal transfers that has the highest correlation with improved consumer sentiment,” he said. “In real terms, they were 14% higher year-on-year in Poland in the third quarter [of 2023], while the EU average was only 1%.”

“Most EU countries found it necessary to tighten their belts in a period of high inflation. However, it turned out that inflation was driven less by demand than expected and more by supply disruptions, so cooling demand was of little benefit.”

Last year, Poland held parliamentary elections in October, ahead of which the government announced increases in social spending, including raising child benefits and introducing a mortgage subsidy programme. The new government that took power in December has promised to protect most such spending.

Inflation stood at 3.9% in Poland in January, decelerating sharply from 6.2% in December.

It was the lowest figure in almost three years, during which time inflation reached a peak of 18.4% in February last year.

Read our full report here: https://t.co/2RAe2zzhgm pic.twitter.com/zZ90XJfKnl

— Notes from Poland 🇵🇱 (@notesfrompoland) February 15, 2024

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Gustavo Fring / Pexels

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.