Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Poland recorded the largest increase in housing prices among European countries last year, while Kraków saw the biggest rise among cities, a new report by consultancy Deloitte has found.

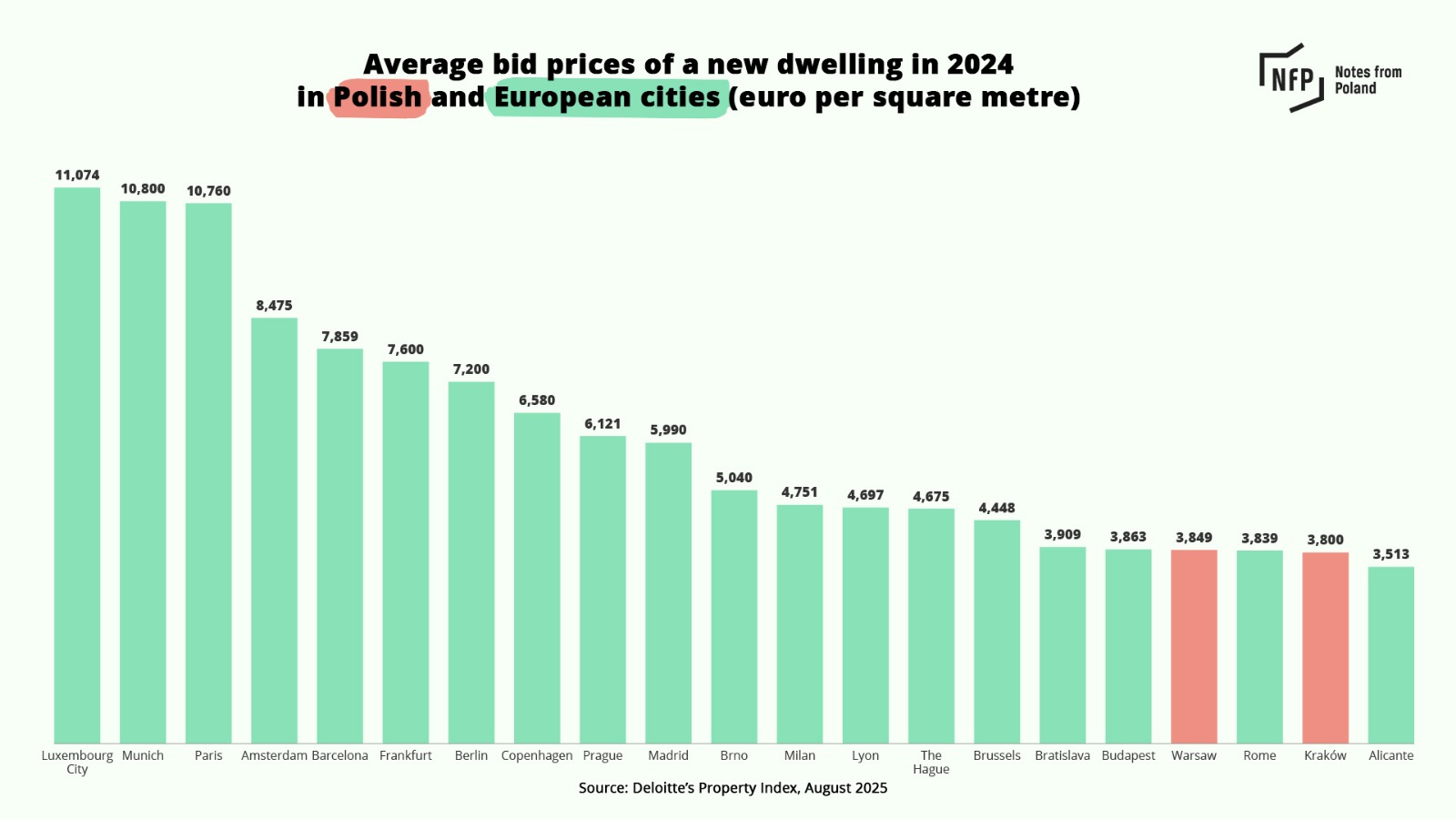

Meanwhile, the average cost per square metre of a new home in the Polish capital, Warsaw, is now higher than in its Italian counterpart, Rome.

Deloitte examined 27 European countries plus Israel, as well as 75 individual cities in those countries. To provide a standardised measure across them, it compared the average bid price per square metre in 2024 for newly built residential properties.

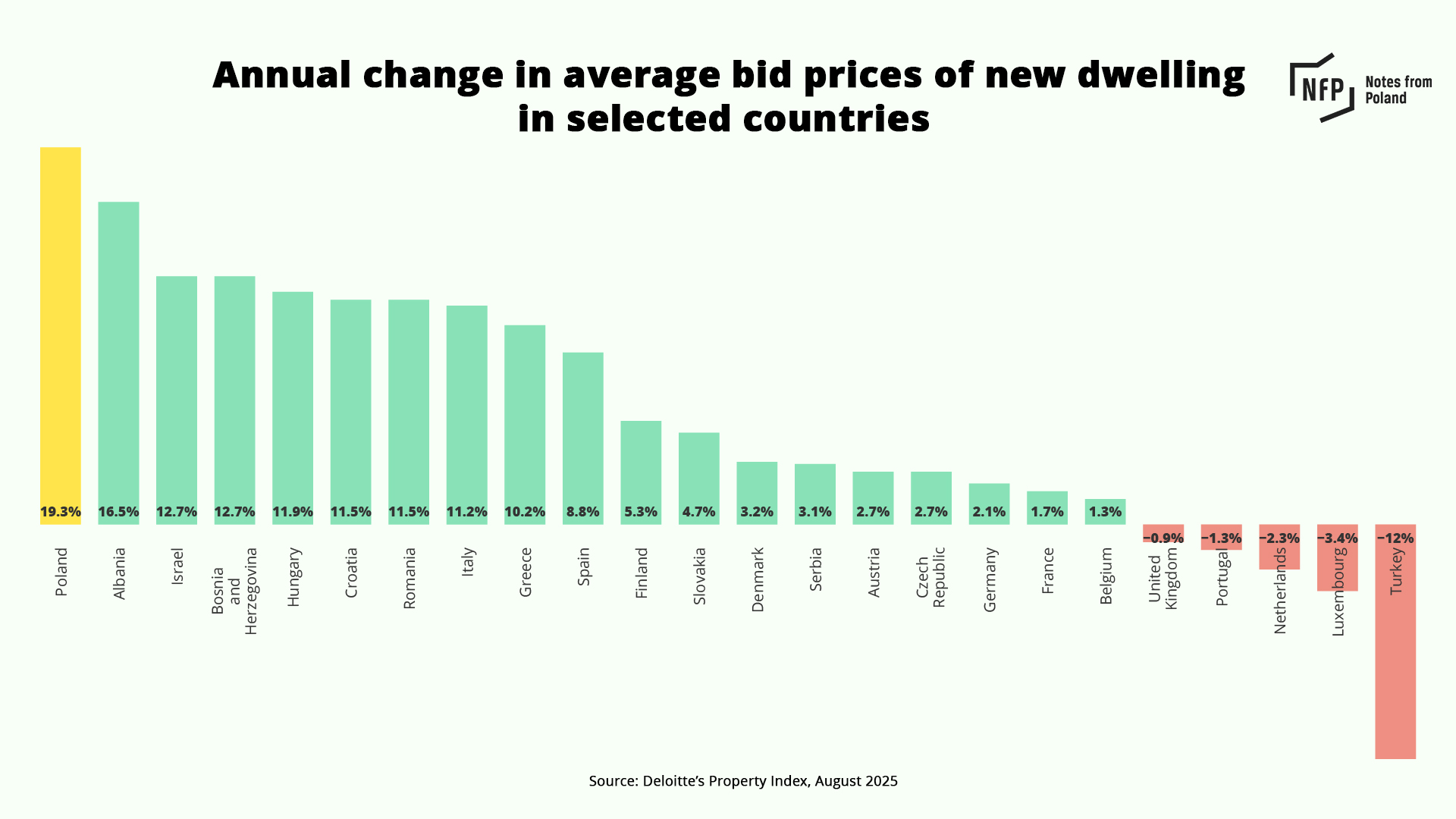

Prices in Poland rose by 19.3% year-on-year, ahead of Albania (16.5%), Israel (12.7%) and Bosnia and Herzegovina (12.7%). Among other European Union states, the biggest rises after Poland’s were in Hungary (11.9%) and Croatia (11.5%).

However, in absolute terms, the average price per square metre in Poland (€2,792) remained below the European average and well below the likes of the United Kingdom (€5,203), Germany (€4,800) and the Netherlands (€4,157).

Meanwhile, among individual cities, Deloitte found that prices in Kraków, Poland’s second-largest city, rose 28.1% in 2024, which was more than anywhere else. It was followed by Jerusalem (25.2%) in Israel and the Albanian cities of Tirana and Vlorë (both 25%).

Another Polish city, Łódż (22.7%), was also near the top of the ranking while Warsaw (21.7%) saw the third-largest rise among all capital cities. The average bid price for a new dwelling in Warsaw reached €3,849 per square metre in 2024, which saw it overtake Rome (€3,839).

Similar price levels, however, were reported in other central and eastern European capitals, including Bratislava (€3,909) and Budapest (€3,863). By contrast, Europe’s most expensive cities remain far ahead, led by Luxembourg City (€11,074), Frankfurt (€10,800) and Paris (€10,760).

Affordability, however, remains stronger in Poland. The price-to-income ratio – showing how many average gross salaries are needed to buy a 70-square-metre apartment – is 15.0 in Prague, 12.3 in Bratislava and 11.4 in Budapest, compared with 9.7 in Warsaw and 9.3 in Kraków.

Poland’s sharp rise in housing prices in recent years has been fuelled by a combination of limited new supply and surging demand, due in part to state-backed mortgage subsidies for first-time buyers.

The number of newly completed apartments fell steeply in 2024, with Warsaw posting a 37% decline compared with the average of the previous five years. Wrocław saw a 45% drop, Katowice 23% and Kraków 15%.

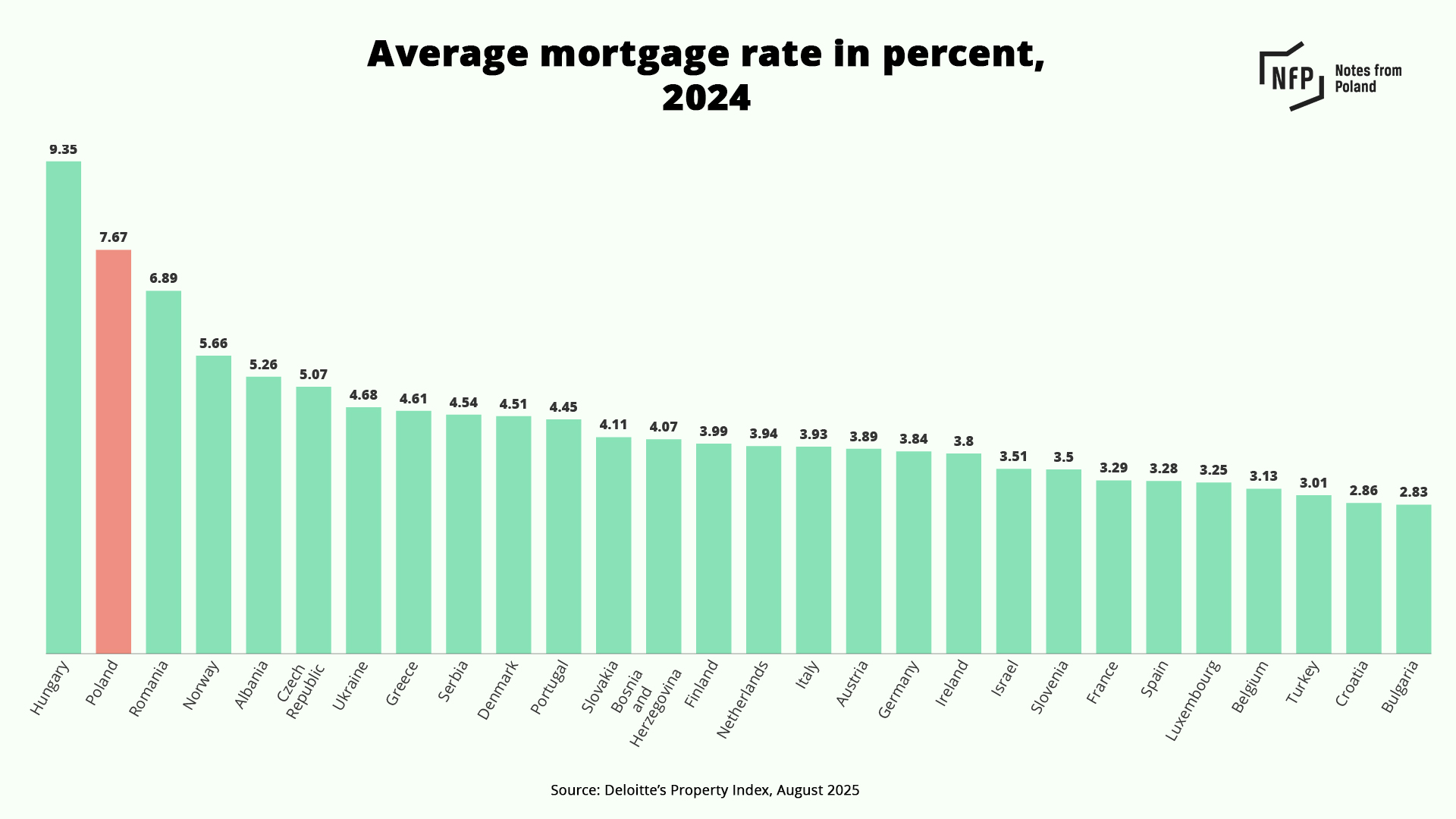

Deloitte also found that the average mortgage rate in Poland, at 7.67%, was the second-highest among the 28 countries surveyed.

“Despite these challenges, there are signs of potential recovery in the housing sector,” noted Deloitte in its individual report on Poland, pointing to data showing a rise in building permit issuance.

The consultancy’s findings mirror Eurostat data, which showed Poland posting the EU’s fastest annual housing price growth in the first three consecutive quarters of 2024, before momentum faded sharply at year-end.

The reversal followed political wrangling over housing support, with Prime Minister Donald Tusk’s coalition split on whether to restore the subsidies for first-time buyers introduced under the former Law and Justice (PiS) government.

Under that programme, which expired at the end of 2023, mortgage rates for first-time buyers were capped at 2% for 10 years, with the state covering the rest.

House prices in Poland grew by 10.4% year-on-year in the final quarter of 2024.

That was four percentage points lower than the annual growth recorded in the previous quarter, marking the sharpest deceleration in the EU, new @EU_Eurostat data show https://t.co/Pe2AJLjhhp

— Notes from Poland 🇵🇱 (@notesfrompoland) April 8, 2025

While Tusk pledged to revive the programme in a modified form, divisions within the coalition he leads, stretching from left to centre-right, have delayed agreement.

The Left (Lewica) opposes any fresh subsidies, arguing they inflate prices further, and instead wants expanded state investment in rental housing. As expectations for a renewed scheme diminished, the pace of price growth cooled.

In the first quarter of 2025, housing prices in Poland rose at an annual rate of 6.6%, placing the country in the middle of the EU rankings and well below Portugal, which led the bloc with a 16.3% increase.

Poland’s government has approved a bill to increase spending on social housing to at least 2.5bn zloty this year, up from 1bn zloty in 2024.

It wants to finance the construction or renovation of 15,000 housing units by local authorities this year https://t.co/6vIwiRkPos

— Notes from Poland 🇵🇱 (@notesfrompoland) March 21, 2025

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit:Wiktor Karkocha/Unsplash

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.