Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

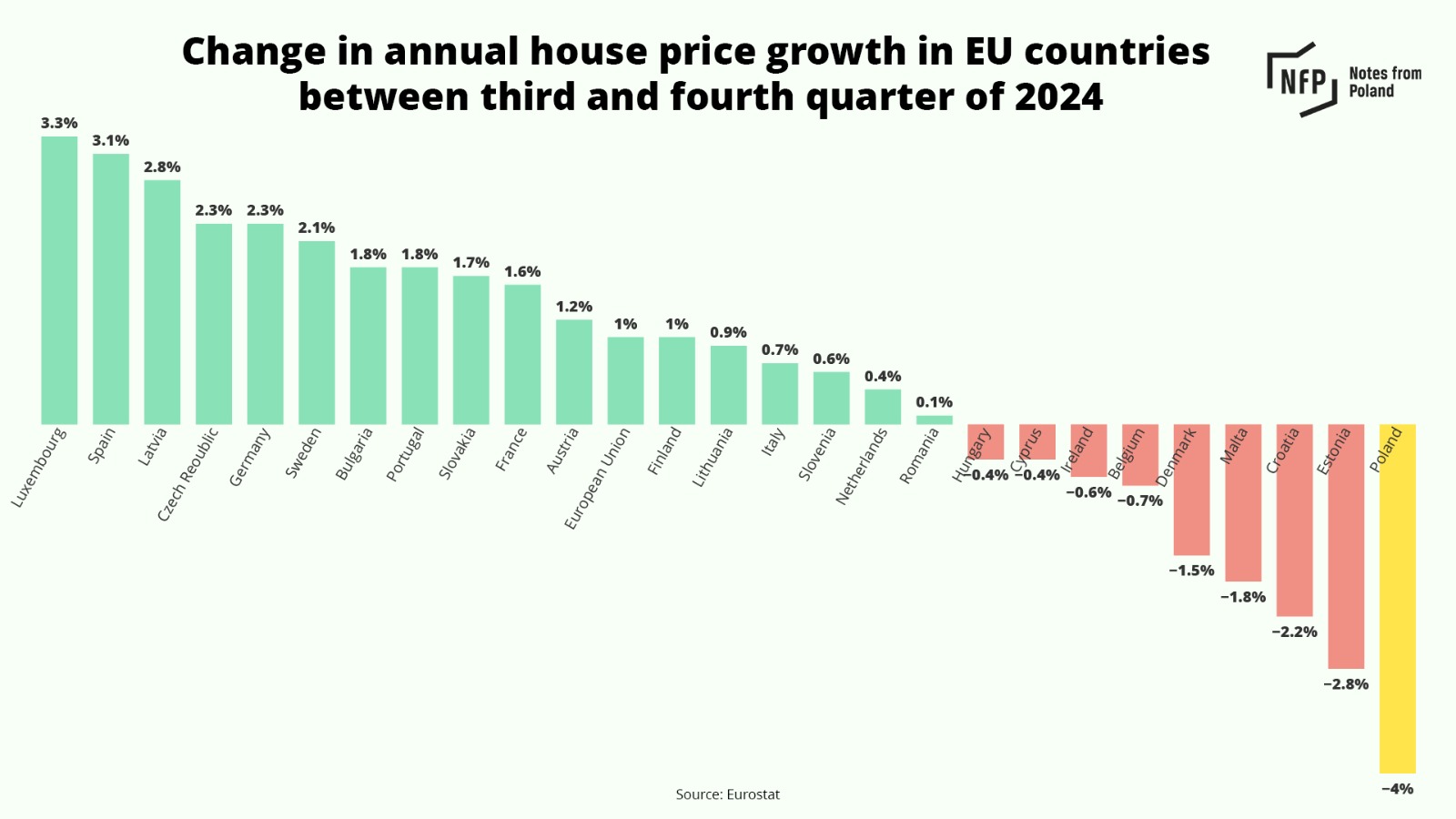

Annual house price growth in Poland slowed to 10.4% in the final quarter of 2024, down by four percentage points compared to the previous quarter and marking the sharpest deceleration in the European Union, new Eurostat data show.

The slowdown follows the ruling coalition’s failure to agree on reintroducing a subsidised mortgage scheme for first-time buyers. The programme, introduced by the previous Law and Justice (PiS) government, was widely credited with driving what was until recently the EU’s fastest house price growth.

The new figures echo earlier findings from Poland’s central bank, which reported a broader cooling in the housing market, including quarterly declines in secondary market prices across half of the country’s provincial capitals, including Warsaw.

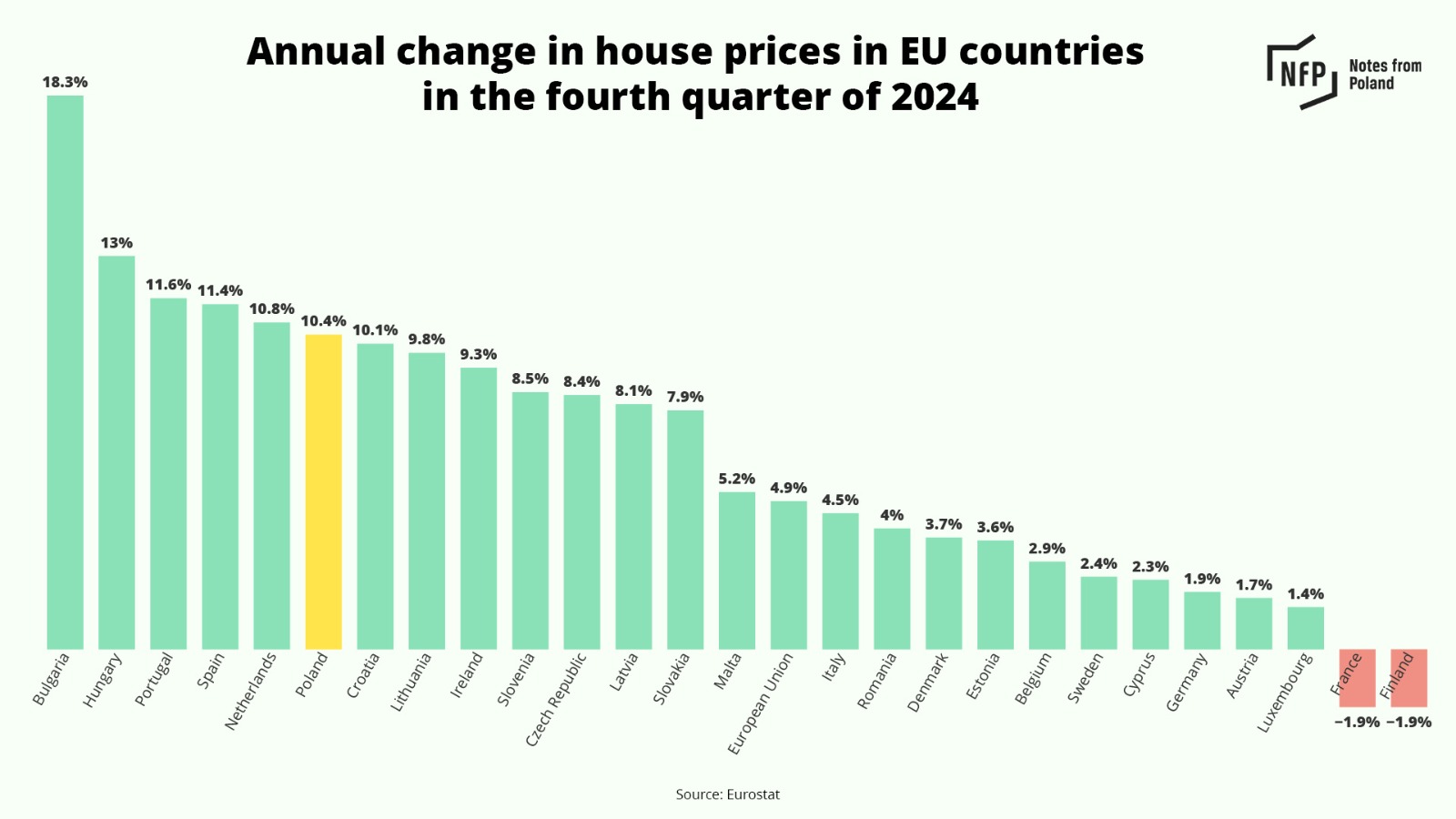

Eurostat’s data show that, in the fourth quarter of 2024, house prices in Poland were 10.4% higher than a year earlier. That was the sixth-largest rise among EU member states, behind Bulgaria (18.3%), Hungary (13.0%), Portugal (11.6%), Spain (11.4%) and the Netherlands (10.8%).

The figure across the EU as a whole was 4.9%, with only two countries (France and Finland) seeing declines in prices (both of 1.9%).

Quarter-on-quarter, Polish house prices rose by 1.2% in Q4 2024, which was the 13th highest increase in the EU and above the bloc’s average of 0.8%. The largest gains were seen in Slovakia (3.6%), Slovenia (3.1%) and Portugal (3.0%).

The new data mark a change from the previous three quarters, in each of which Poland recorded the EU’s highest annual house price rises, with a peak of 18% year-on-year growth in Q1 2024.

The growth was driven in particular by demand stoked through the mortgage subsidies for first-time buyers introduced under the former PiS government in mid-2023.

Mortgage lending in January 2024 topped 10 billion zlotys (€2.34 billion) for the first time, as buyers rushed to finalise contracts before the programme expired.

Prime Minister Donald Tusk, who took office in December 2023, pledged to relaunch the subsidy scheme in a modified form. However, his broad coalition, which ranges from left to centre right, has since failed to reach a consensus on its design.

The Left (Lewica), a junior coalition partner, opposes mortgage subsidies altogether, arguing they inflate property prices. It advocates instead for an increased supply of affordable rental housing.

Poland has recorded the highest annual rise in housing prices in the EU for the third quarter in a row.

Prices rose by 17.7% year-on-year in the second quarter of this year, compared to an EU average of 2.9% https://t.co/y2lfGQa9yY

— Notes from Poland 🇵🇱 (@notesfrompoland) October 7, 2024

As market expectations for a renewed scheme faded, price growth began to weaken. Recent data from the National Bank of Poland (NBP) for Q4 2024 also confirmed a broader cooling.

Year-on-year growth in nominal transaction prices on both the primary and secondary markets across the country’s ten largest cities slowed to 11.6% and 11.8% respectively, down from 13.8% and 16.3% in the previous quarter.

Additionally, for the first time since early 2023, the NBP reported a quarterly decline in secondary market prices across these cities, which were down 1% overall. In Warsaw, prices fell by 6.2% quarter-on-quarter

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: StockSnap / Pixabay

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.