By Adam Czerniak

Russia’s military aggression against Ukraine in February 2022 unleashed a wave of migration on a scale not seen in Europe since the end of World War Two. Neighbouring Poland was one of the main destination countries for the eight million Ukrainians who fled the war.

At the peak moment, almost 1.4 million refugees were receiving temporary protection in Poland, making up 3.6% of the country’s population. Only the Czech Republic gave temporary protection to a higher percentage of the population (4.3%).

Scholarly research suggests that the impact of migration on the economy becomes noticeable if the number of people arriving in a country is more than 0.5% of its population.

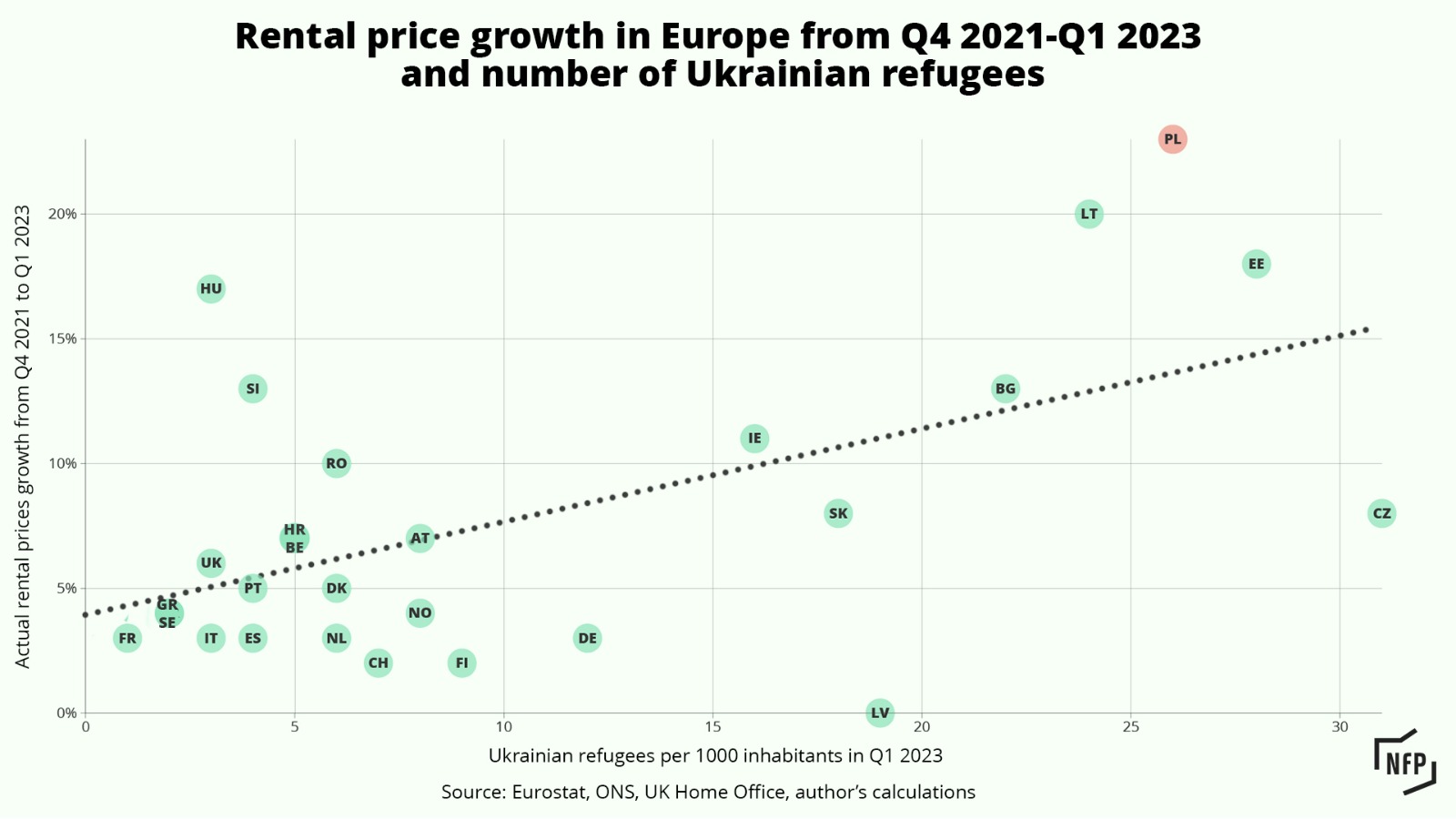

Poland’s sudden population growth caused a domino effect, impacting numerous aspects of socioeconomic life, including the housing market. Initial research and media reports suggested that the influx of migrants had caused rental prices to spike. OECD data show that Poland has recorded among Europe’s largest increases in rental prices in recent years.

Yet my research has shown that the actual impact of wartime migration on the Polish rental market has proven to be smaller than was commonly thought, responsible for no more than a fifth of the acceleration in prices in 2022. A perfect storm of several macroeconomic trends accounts for the rest.

Poland’s rental market prior to the war

The Russian attack on Ukraine took place at a moment of particular instability in the European housing market. A period of rapid growth of property prices – owing largely to low interest rates – was ending in practically all European countries.

The Polish housing market began to cool in autumn 2021 as the central bank raised interest rates. The effect was compounded by tightened conditions for mortgage lending by the Financial Supervision Authority (KNF) in spring 2022.

This caused restrictions on the financial accessibility of homes. Many Poles now found that buying their own apartment was out of their reach, unless their income was well over the national average. As a result, some people had no option but to rent, thus increasing pressure on rental prices.

The cost of rent in Poland has risen 62% since 2015 – the fifth-fastest growth among @OECD countries – with a particular increase after the arrival of Ukrainian refugees.

Between 2015 to 2022, the average wage rose 24.5%, far lower than rental increases https://t.co/Ft3qzgNRF7

— Notes from Poland 🇵🇱 (@notesfrompoland) December 21, 2023

Furthermore, this came at a time when many renters were returning to cities, such as students and office workers who had gone back to their hometowns during the pandemic.

These cyclical factors overlapped with the structural problems of the Polish property market – a housing shortage in large cities, a low supply of rental premises outside of the biggest agglomerations, as well as inactivity from the state in housing policy.

For this reason, Poland was much less well prepared than the countries of Western Europe – at least in theory – for admitting large numbers of refugees from Ukraine.

The initial wave of migration

The majority of refugees received free accommodation from volunteers or humanitarian organisations in the first weeks after arriving in Poland. Private owners of homes in which refugees were hosted for free were eligible to receive state financial support.

The very high public engagement made it possible to absorb the demand shock. In the early weeks, it proved possible to find accommodation for practically all those who needed it. However, many families hosting refugees immediately began looking for another place for them to stay, particularly in the rental market.

Around 77% of Poles have been involved in helping refugees from Ukraine, for which purpose they spent around €2 billion out of their own pockets, a new study by @PIE_NET_PL has found https://t.co/xWu8JWNMui

— Notes from Poland 🇵🇱 (@notesfrompoland) July 28, 2022

This, along with searches by refugees themselves, generated pressure on rent price increases. Furthermore, it was especially wealthier Ukrainians, often with financial means to pay above the market rate, who decided to leave their home country during this period.

The actual impact of refugees on rent prices

In the period preceding Russia’s attack, the rental rates paid by tenants in Poland grew relatively quickly – by 3.9% year-on-year in 2020 and 6.5% in 2021, much higher than the EU average of 1.2% in 2020–2021.

This was a result of higher inflationary pressure than in other countries, which began to increase in Poland before the pandemic, before being further driven by 100 billion zloty (€23 billion) being pumped into the economy in the shape of public aid programmes, as well as a rapid growth in housing prices, encouraging landlords to raise rental rates.

In this macroeconomic environment, the effect of the influx of war refugees was on the one hand stronger, overlapping with already growing supply shortages, but on the other less visible, as it was combined with an existing growth trend – the dynamic of rental prices in Poland on the eve of the outbreak of war was already 8.5% year-on-year.

The population of Warsaw has risen 17% due to the arrival of 300,000 refugees from Ukraine

President Duda yesterday "appealed to the entire international community" for help with the refugee crisis. Otherwise "we will be in a very difficult situation" https://t.co/9JBDNfAoBv

— Notes from Poland 🇵🇱 (@notesfrompoland) March 17, 2022

Average rental rates were the first to be affected by the sudden influx of refugee families. Between 24 February and 31 March 2022, the average price of an apartment available for rent on the Otodom website increased by 14%.

In the following months, owing to a major shortage of rental offers, rates continued to grow, stabilising only towards the end of 2022 at a level 20-35% higher than before the outbreak of war, with the largest rises recorded in cities with more than 500,000 residents.

The scale of price increases in rental agreements signed before the war was much smaller and more spread over time – in February 2023 the year-on-year dynamic of rental rates was 18.8%, i.e. 10 percentage points more than at the outbreak of war.

Sorry to interrupt your reading. The article continues below.

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

But the acceleration of rates cannot be put down entirely to the war. Inflation grew at the same time, with interest rates raised to levels not seen in Poland for 20 years.

Based on pan-European econometric studies, we can conclude that war migration caused a growth in rental rates in Poland of between 1 and 2 percentage points, so it was responsible for at most a fifth of the acceleration in rents observed in 2022. The rest resulted from other macroeconomic processes.

This suggests that the impact of Ukrainian war refugees on rental prices in Poland has been less than is generally assumed. Two overlapping factors led to this erroneous perception.

Firstly, the more accessible measures of rental (offer) prices gave a false image of a very large, sudden rise in rates. This was, however, a statistical effect of the drop in available low-cost housing offers, which were rented first.

Secondly, many landlords exploited the shortage of supply and the growth of offer prices to justify increasing rental prices, which was in fact motivated by the higher interest costs of mortgages and a general fall in the value of money.

The impact of refugees on property prices

The war in Ukraine and the associated influx of refugees also affected the property market. Unlike the rental market, however, this was an indirect impact involving changes in the purchase decisions of Polish citizens.

A small proportion, fearing the consequences of the war potentially spilling over into Poland, decided against buying houses and apartments in border areas or opted to buy property in countries in the eurozone, especially Spain. This resulted in a relatively slower growth of housing prices in areas bordering with Ukraine.

Poles purchased almost 3,000 residential properties in Spain last year, a record figure and annual rise of 160%.

We visited the Costa Blanca to look at what is behind this trend and how the growing Polish presence is being felt https://t.co/FBoqmvyHe8

— Notes from Poland 🇵🇱 (@notesfrompoland) June 6, 2023

Contrary to popular opinion, however, refugees did not buy property en masse, especially with mortgages, including state-subsidised ones.

For example, the value of housing loans granted to citizens of Ukraine in the first three quarters of 2022 was just 1.1 billion zloty (€256 million), 9.1% less than in the equivalent period of 2021, while only 3% of mortgage lenders benefiting from the Polish government’s 2% Safe Credit scheme had Ukrainian citizenship.

The lack of interest among Ukrainians in buying an apartment resulted from the high uncertainty that came with war migration. Most refugees did not know – and remain unsure – whether their current place of residence was their ultimate destination. Whether they will soon be able to return home, where they will get the best job offer, or if they will decide to migrate further west.

Only later, therefore – probably after the end of the armed conflict – will it be possible to see the true lasting impact of the war on the housing market in Poland and other Central and Eastern European countries.

This article is based on academic research conducted by the author, including “The Impact of Ukrainian War Refugees on Rental Prices in Europe: A Panel Data Analysis”, published in 2024 in the journal Critical Housing Analysis, and the book Ekonomia Wojny. Skutki społeczne, ekonomiczne i geopolityczne wojny w Ukrainie (The Economics of War: Social, Economic and Geopolitical Effects of the War in Ukraine) edited by Dorota Niedziółka and Mariusz Próchniak.

Translated by Ben Koschalka

Main image credit: Komarov Egor 🇺🇦/Unsplash