With inflation at its highest level in a quarter of a century, Poles are not only tightening their belts but also looking to increase their earnings by seeking pay rises, moving to better-paid work, and in many cases taking on a second job.

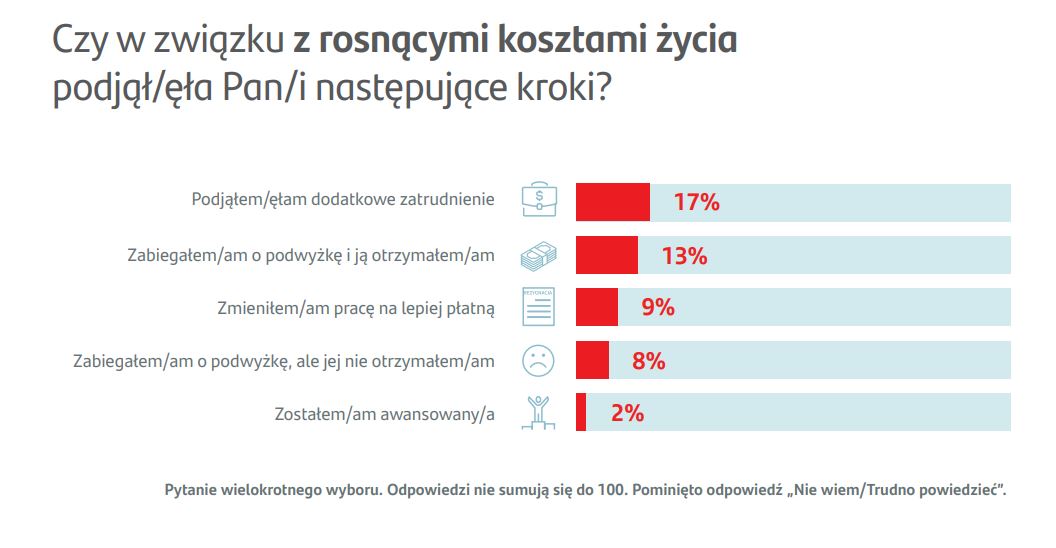

A newly published survey by IBRiS for Santander Consumer Bank found that 17% of Poles say they have secured additional employment in response to the rising cost of living. Meanwhile, 13% say they have received a pay raise while 8% sought one but failed to obtain it. Another 9% have moved to a better-paid job.

Most Poles, 70%, nevertheless saw their financial situation deteriorate over the last year, Santander’s study shows. That is significantly more than the 50% who said the same last time the survey was conducted in spring 2022.

This year, only 11% say they have seen an improvement in their finances, compared to 15% last year.

The most commonly given cause for dissatisfaction with the state of people’s finances was rising food prices, which was indicated by 84% of those surveyed. The next most common complaints were fees and bills (67%) and fuel costs (48%).

These responses are consistent with inflation readings, which show that soaring prices have been driven primarily by increases in in food, energy and transport costs in recent months. In February, inflation accelerated again to reach 18.4%, its highest level since 1996, while average wages rose by only 13.6%.

Annual inflation accelerated again to reach 18.4% in February, its highest level since 1996.

Economists believe that the figure will mark a peak and price growth will slow in the coming months.

For more, see our report: https://t.co/jQiEj7pqh7 pic.twitter.com/huAoyvCclS

— Notes from Poland 🇵🇱 (@notesfrompoland) March 15, 2023

Santander found that, when faced with rising costs, Poles are most likely to cancel weekend and holiday trips (65%), reduce electricity consumption (64%), and look for products on special offer (64%).

At the other end of the scale, only 5% said they are giving up using their car and switching to bicycles or public transport, while 4% have turned to investing in the stock market and 3% to buying government bonds.

“Only 38% of us [save money] regularly, but perhaps this is the result of a calculation according to which it is not worth saving at the moment due to the fact that money rapidly loses its value,” wrote Santander.

The majority of Poles, 78%, are also not saving for retirement in addition to their existing contributions, which, the bank notes, is a concern given Poland’s shrinking and ageing society. “This is definitely an issue to which we should pay more attention,” the bank said.

A quarter of Poles have no savings, while 35% could only survive for up to a month on what they have put aside.

Amid the pandemic, 52% have been unable to add to their savings and 61% have cut back spending https://t.co/3tjz3B5ahG

— Notes from Poland 🇵🇱 (@notesfrompoland) January 21, 2021

Main image credit: Kai Pilger / Unsplash

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.