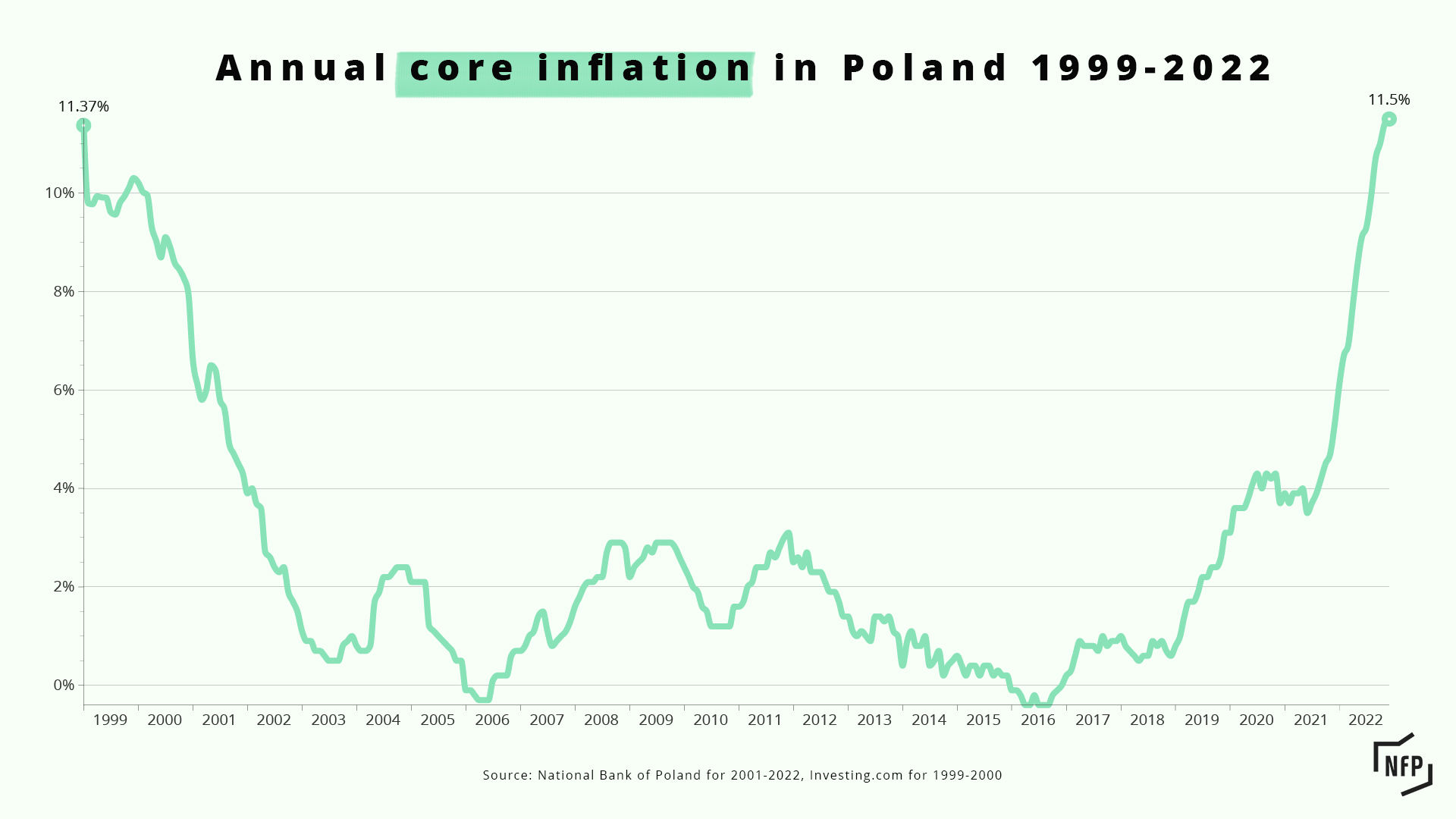

Despite Poland’s main inflation figure beginning to fall over the last two months from its 25-year high, core inflation – a measure that excludes goods with the most volatile prices, such as fuel and food – has continued to rise.

New figures from the central bank show that core inflation reached 11.5% in December, up from 11.4% in November and the highest level since early 1999.

By contrast, the main inflation figure fell in December to 16.6%, the second month in a row it had dropped from a peak of 17.9% in October.

Core inflation is, however, seen to represent a more accurate indicator of underlying long-run inflation and of prices that can be influenced by monetary policy, given that fuel costs are largely set on international markets and food prices are dependent on seasonal factors.

Commenting on the new core inflation data, mBank analysts noted that “we are far from any normalisation in this regard, without which a return to the [central bank’s] inflation target [of 2.5% +/- 1 percentage point] will not be possible”.

Inflation slowed to 16.6% in December, below economists' forecast of 17.3% and down from 17.5% in November.

Experts believe, however, it will accelerate again this year, possibly peaking above 20% in February.

Yesterday the central bank held its benchmark interest rate at 6.75% pic.twitter.com/l7Pf98EWDH

— Notes from Poland 🇵🇱 (@notesfrompoland) January 5, 2023

“What’s next? First of all, it should be noted that, on an annual basis, core inflation in our view will remain in double digits for some time to come. After that, we are probably facing a very slow downward trend,” they added.

“Evidence of this can be found, for example, in the labour market situation and the acceleration of nominal wages,” noted the analysts. “This can hardly be explained by anything other than high inflationary expectations.”

“In other words, employees are demanding pay rises and employers are (perhaps not so willingly) agreeing to them, knowing that they will then be able to raise the prices of the goods and services they sell,” they added.

Economists have also cautioned that the headline inflation figure is likely to rise again in early 2022, due to the impact of the withdrawal of anti-inflationary measures by the government and the effect of the low base of the previous year.

According to Ludwik Kotecki, a member of the central bank’s rate-setting council, headline inflation in January could rise above 18% for the first time since late 1995.

Main photo credit: Sam Lion / Pexels

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.