Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

A natural gas pipeline linking Poland and Slovakia has hardly been used since opening to much fanfare three years ago. Data show that no gas at all has flowed from Poland to Slovakia since March 2024, as Bratislava continues to instead rely on Russian supplies.

Ahead of the opening of the €100 million interconnector, the EU’s then energy commissioner, Kadri Simson, said that the pipeline represented “another step in helping this region to be fully integrated into the internal EU energy market, diversifying away from Russian gas”.

However, it has remained largely idle in the three years since, according to data from the ENTSOG Transparency Platform, an EU gas flow aggregating website.

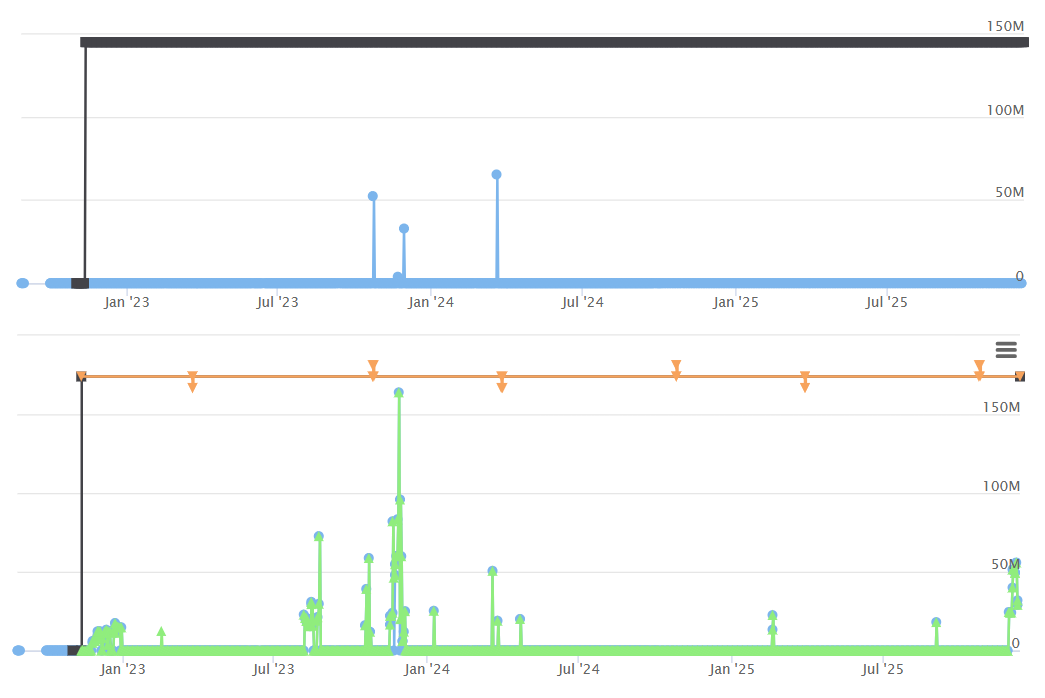

Apart from brief spikes of activity in late 2023 and early 2024, no gas has flowed from Poland to Slovakia. There have been more regular flows in the other direction, but the data show regular periods of many months in which the pipeline is not being used at all.

Gas flow (in millions of kilowatt-hours per day) through the interconnector from Poland to Slovakia (top chart) and Slovakia to Poland (bottom chart). Source: ENTSOG Transparency Platform

Interconnectors allow countries to move gas back and across borders, helping to balance regional supply and demand. Poland has such links with almost all neighbouring countries, with the exception of Russia’s Kaliningrad exclave. The Polish-Slovak link is the only one to remain largely idle.

In comments to Notes from Poland, the Polish gas transmission operator, Gaz-System, admitted that “the level of utilisation is low”, saying that flows “depend on market demand”.

Landlocked Slovakia has negligible domestic gas production and is almost entirely dependent on imported pipeline gas.

After Russia’s full-scale invasion of Ukraine, it continued to import Russian gas, citing contractual obligations to Gazprom. In 2023, a new government took office led by Prime Minister Robert Fico, who has criticised EU sanctions on Moscow and said that Russian gas remained essential for the Slovak economy.

The halt of Russian gas transit via Ukraine at the start of this year had raised expectations that the Slovak-Polish interconnector would finally be used, but this did not happen. Russian gas continues to reach Slovakia from Hungary via the TurkStream pipeline.

However, EU plans to ban imports of Russian gas after 2027 could eventually force Slovakia’s hand and bring the largely dormant Polish-Slovakian interconnector into operation.

“This may certainly encourage many market participants to seek alternative sources of gas supplies, including from Poland,” Gaz-System told Notes from Poland. “The interconnector with Slovakia could become an important element of a regional gas hub.”

A record amount of natural gas has been traded in Poland this year, surpassing the levels seen before Russia’s full-scale invasion of Ukraine.

The share of gas in Poland's electricity production also reached an all-time record high of 19% last month https://t.co/oqFd1kat6J

— Notes from Poland 🇵🇱 (@notesfrompoland) December 9, 2025

The latter remarks refer to Poland’s ambitions to serve as a hub for gas supplies to neighbouring countries, such as Ukraine, the Czech Republic and Slovakia.

Poland already imports most of its gas via the Baltic Sea: through the Baltic Pipe that brings gas from Norway and through its liquefied natural gas (LNG) terminal in Świnojście, which receives shipments from countries such as the United States and Qatar.

Construction of a second LNG terminal, which will be located in Gdańsk, began earlier this year and Gaz-System is currently in the process of gauging market interest in the region before deciding whether to commission a third terminal, also in Gdańsk.

Poland’s gas market has been booming this year, with a record 189.3 terawatt hours (TWh) traded so far on the Polish Power Exchange, surpassing pre-war levels. Gas now accounts for almost a fifth of the country’s electricity production, supporting Warsaw’s ongoing shift away from coal.

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Gaz-System press materials

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.