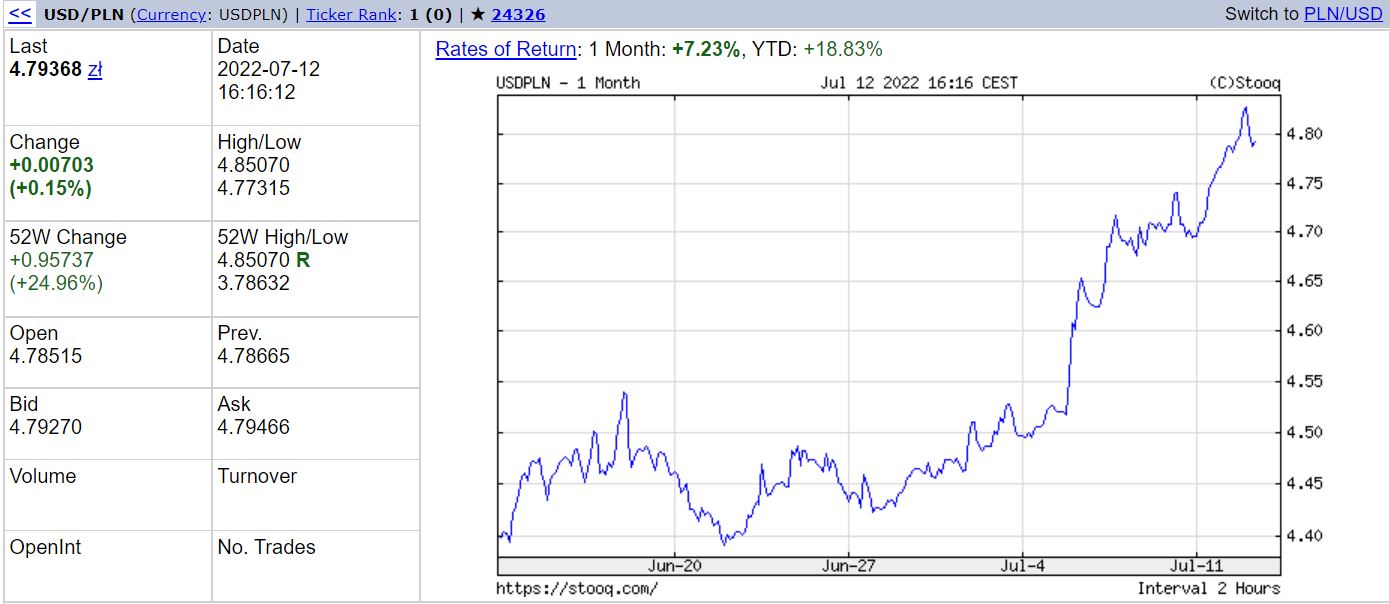

The zloty was trading as low as 4.85 to the US dollar on Tuesday, its lowest level since the Polish currency was redenominated in 1995.

In recent months, the zloty has weakened against all major currencies, including the dollar, euro and Swiss franc, as investors fled to safer assets in fear of a worsening economic situation. The Polish currency has lost around 25% of its value in a year against each of those three currencies.

The zloty was also weighed down by slower interest rate rises than in other countries in the region, as well as a conflict with Brussels that has left Poland still waiting for billions of euros from the European Union’s Covid recovery fund.

Source: stooq.pl

In March, shortly after Russia’s invasion of Ukraine, the zloty also reached its lowest level against the euro, temporarily falling beyond 5 zloty to the euro.

Though it has since recovered some of those losses, it has begun to fall again after a smaller-than-expected interest rate hike this month. On Tuesday afternoon, the currency was trading at 4.81 to the euro.

“Credit holidays [and] a smaller-than-expected rate hike do not give investors any reason to look at the zloty with a kinder eye,” said Przemysław Kwiecień, chief economist at XTB brokerage, in a comment published by FxMag.

Last week, parliament approved a bill that would introduce “credit holidays” by allowing borrowers to temporarily suspend mortgage repayments for four months this year and next year.

Za 1 dolara płacono we wtorek przed południem 4,85 zł – najwięcej w historii. Euro osiągnęło na chwilę parytet z dolarem. #złoty #dolar #euro https://t.co/HiOHOwoS7B

— Rzeczpospolita Ekonomia (@RPEkonomia) July 12, 2022

According to Kwiecień, the zloty’s situation will not improve as long as the euro does not strengthen. In recent days, the euro slid towards dollar parity, a situation in which one euro would trade for one dollar.

The euro affects the exchange rate of the zloty, as the eurozone is Poland’s main trade partner.

“The market fears not only a recession in Europe but events unthinkable until recently, such as a lack of electricity or hot water,” said Kwieciński, adding that in this environment the zloty might even weaken above 5 per dollar.

Dolar jest w Polsce najdroższy od 22 lat. Ale słabą walutę mamy od ponad dekady. Dlaczego złoty jest tak słaby, skoro nasza gospodarka rosła do tej pory bardzo szybko i była przykładem sukcesu? – analizuje @iggnacy główny ekonomista @puls_biznesu https://t.co/F83vbdeERz

— Grzegorz Nawacki (@nawacki) July 7, 2022

According to another expert, former National Bank of Poland (NBP) rate setter Marian Noga, the central bank may in this situation decide to intervene in the foreign exchange market to bring down the dollar against the zloty.

“Our National Bank of Poland is weak in verbal interventions. One could say that they are even having the opposite effect. What [central bank] Governor Adam Glapiński and some other [rate setters] are saying is bad for the zloty. In my opinion, there will be a traditional intervention by the NBP,” he told news service Gazeta.pl.

In recent years, the NBP has made several direct interventions in the foreign exchange market, including selling foreign currencies for zlotys shortly after the outbreak of the war in Ukraine, in response to the plunging value of the currency at that time.

Main photo credit: Nathan Dumlao/Unsplash

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.