Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

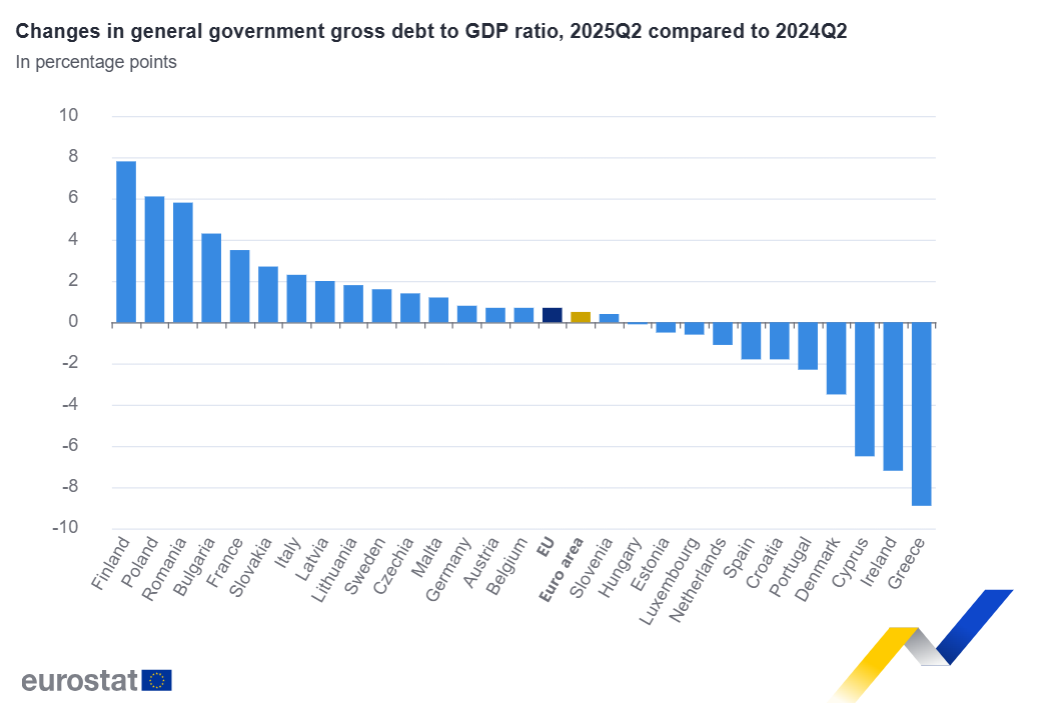

Poland has recorded the EU’s second-fastest annual increase in public debt, according to new figures from Eurostat.

While Poland’s overall level of public debt remains well below the EU average, its recent rapid increase has prompted concern over the country’s finances and action from the European Commission, which last year placed the country under its excessive deficit procedure.

Public debt in Poland rose to 58.1% of gross domestic product (GDP) at the end of the second quarter of this year, up 6.1 percentage points from the same period a year earlier. Only Finland saw a faster increase, with debt rising 7.8 points to 88.4% of GDP, according to Eurostat.

The EU statistical agency reported that the average public debt-to-GDP ratio across the EU stood at 81.9% at the end of the second quarter, while the eurozone average was higher at 88.2%.

Greece remained the bloc’s most indebted country, with public debt at 151.2% of GDP, followed by Italy at 138.3% and France at 115.8%. Estonia (23.2%), Luxembourg (25.1%), and Bulgaria (26.3%) had the lowest debt ratios. Poland ranked 13th among EU members.

“However, there are many indications that we will gradually move up in this inglorious ranking,” wrote Tomasz Hońdo, a financial analyst at Quercus TFI, noting that the government’s latest debt strategy projects debt rising to 75% of GDP by 2029.

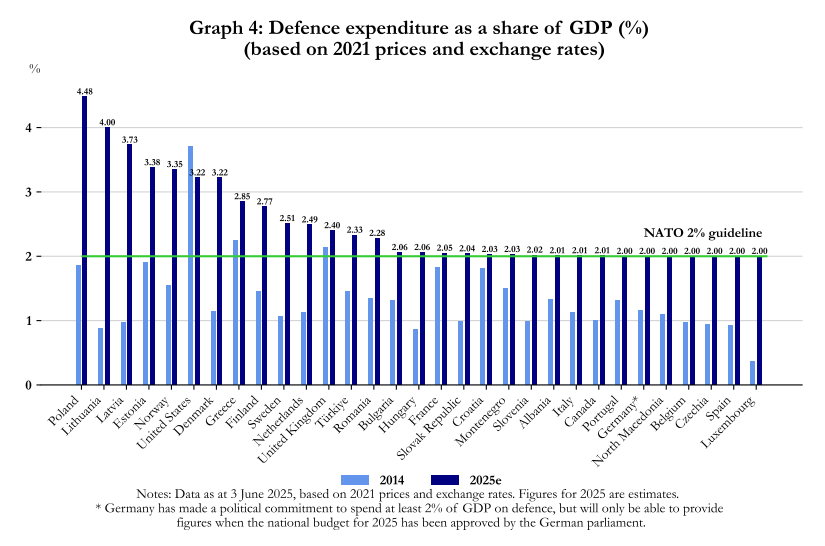

Poland has been running sizeable budget deficits in recent years as it boosts social spending and ramps up defence investment following Russia’s full-scale invasion of Ukraine.

Economists warn that, despite strong economic growth, the government has shown little determination to rein in spending or curb the debt burden. They argue that temporary tax measures and ad hoc revenue increases will not be enough to reverse the rising debt trend.

Finanse publ. – odc. 2. Polska wśród krajów UE, które najszybciej zwiększają dług publiczny w ostatnich latach.https://t.co/hTOG4ZpBBO pic.twitter.com/4AUExk3LOA

— Tomasz Hońdo, CFA (@TomaszHondo) October 23, 2025

According to Poland’s finance ministry, Poland’s public finance deficit reached 201.4 billion zloty (€47.6 billion) between January and September, equivalent to 69.8% of the record shortfall of up to 289 billion zloty set in the annual budget for this year. The government expects a deficit of 271.7 billion zloty in 2026.

Hońdo points to the cumulative effect of the budget deficit in rising debt. “Over the past three years – since 2022, when the war in Ukraine began – [Poland’s] public debt under the EU definition has risen by nearly 11% of GDP,” he wrote.

This was the third-largest increase in the bloc after Finland and Romania in that period. “Of course, this can be partly explained by the need for military spending (it’s no coincidence that the largest rise is seen in Finland),” he added.

Poland’s defence spending has surged to the highest level in NATO relative to GDP, adding pressure to already stretched public finances.

Poland has been under the EU’s excessive deficit procedure since last year, after its deficit exceeded the bloc’s 3% of GDP limit. Warsaw has pledged the fastest possible correction, aiming to bring the deficit down to 2.9% by 2028.

Janusz Jankowiak, chief economist at the Polish Business Roundtable, however, described the latest actions proposed by the government to amend the situation, which include raising the VAT rate to 23% on non-alcoholic versions of alcoholic beverages and tightening tax enforcement, as “harvesting peanuts”.

“This will not stop the trend of increasing public debt,” he said, noting also that some of the plans to raise taxes may never enter force, as they may get vetoed by opposition-aligned President Karol Narocki.

Last week, as part of efforts to increase taxes, the Polish parliament approved a hike of corporate income tax for banks, a move described by the finance ministry as a form of “social justice” given banks’ high profits during a recent period of high interest rates. It remains to be seen whether Nawrocki will sign or veto the bill.

Parliament has approved an increase in corporate income tax for banks from the current 19% to 30% next year, before falling to 23% by 2028.

The finance ministry says the measures are "social justice", but the banking sector calls them discriminatory https://t.co/7GYLO2t4MD

— Notes from Poland 🇵🇱 (@notesfrompoland) October 18, 2025

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.