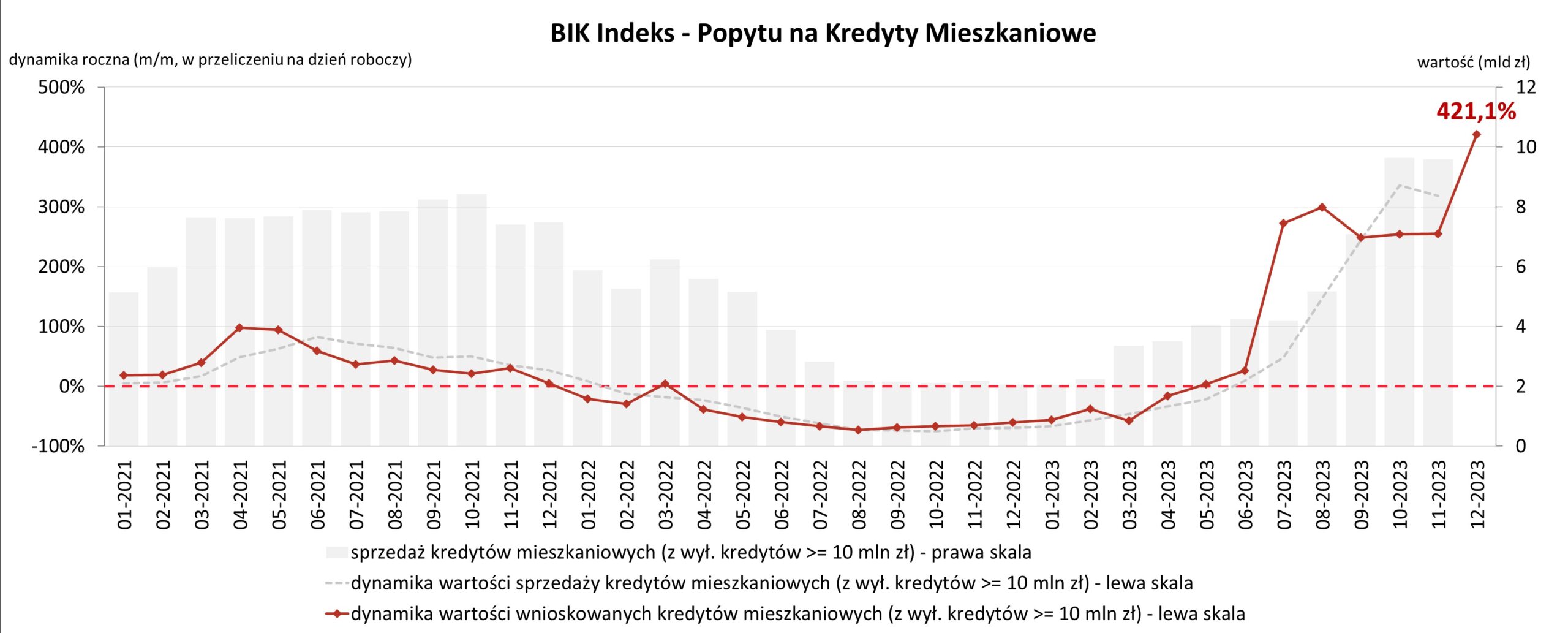

The total value of mortgage applications in Poland rose by 421% year-on-year in December while the number of applications hit a record high of over 46,300, as customers rushed to banks anticipating the end of the popular subsidy programme for first-time buyers launched by the previous government.

The value of the average loan applied for also reached a record high of over 430,000 zloty (around €100,000), following a year of rapid growth in housing prices.

The mortgage-subsidy scheme was, as expected, terminated in the early days of January after funds ran out. But the new government, which came to power last month, has announced work on a new programme.

It appears, however, that the new scheme, which is expected to be launched in the middle of this year, will be available to a narrower group of recipients than before.

Mortgage demand index. Source: Credit Information Bureau (BIK)

In December, the number of individual home loan requests increased by 277% year on year to 46,340 applications, the highest number across the year and up from 12,300 applications in December 2022, show figures released this week by the Credit Information Bureau (BIK).

BIK notes that the high demand for mortgages in Poland was largely due to the subsidies programme launched by the previous Law and Justice (PiS) government, which provided borrowers with a stable mortgage rate of 2% for 10 years, with differences compared to market interest rates covered by the state.

“Among those applying for a home loan in December, as many as 73% of people are potential beneficiaries of the scheme,” said Sławomir Nosal, head of analysis at BIK, adding that rising property prices also contributed to the record level of loans applied for.

The number of people applying for mortgages in Poland tripled year on year in July, while the total value of applications rose over 270% to a record level.

The increase follows the launch of a programme of government subsidies for first-time buyershttps://t.co/F3Au9HiY0H

— Notes from Poland 🇵🇱 (@notesfrompoland) August 9, 2023

The average value of the loan applied for by potential borrowers increased in December by 25.1% year-on-year and reached a record high of 435,270 zloty. Month-on-month, the value of the average loan application increased by 1.6%.

“Such a high value is due both to the increase in property prices and to the fact that a large proportion of those wishing to take advantage of the ‘2% Credit’ scheme are applying for amounts close to the upper limit of the scheme (500,000 zloty for single people and 600,000 zloty for married couples),” said Nosal.

According to data from the zametr.pl platform, which tracks property prices from Poland’s largest real estate websites, prices of new homes in Poland’s largest cities have risen between 6% (in Zielona Góra and Toruń) and 30% (in Poznań) last year.

In the secondary market, prices also rose rapidly, from 4% (in Zielona Góra) to as much as 31% (in Kraków). Transaction prices, however, tend to be lower than offer prices, as shown by data from the National Bank of Poland (NBP).

— zametr.pl (@zametr) January 1, 2024

According to experts, the main reason for such large price increases was high demand amid a fairly low supply and the impact of pent-up demand after months with the highest interest rates in years.

However, with the subsidies programme coming to an end and interest rates remaining high, they expect prices to stabilise this year.

“Of course, there have already been announcements of the creation of a new programme. However, it will take a long time for the legislation to be passed and for the banks to implement the relevant solutions,” analysts at loan broker Expander wrote in a report.

Poland's largest opposition party has proposed offering interest-free mortgages to first-time buyers aged under 45.

We will "actually make housing a right, not a commodity", says PO leader @donaldtusk, echoing a slogan used by the government and The Left https://t.co/sucrD0JEDy

— Notes from Poland 🇵🇱 (@notesfrompoland) February 28, 2023

Last week, the development ministry announced the start of work on the new programme.

According to the initial assumptions, the age limit to benefit from credit subsidies will be lowered to 35 years from 40 years, and the maximum amount up to which subsidies will be available will also be lower in most cases and will depend on the number of people in the household.

The maximum interest rate will also depend on the number of people in the household and will range from 1.5% for singles and couples without children to 0% for households of five people or more.

Nowy program mieszkaniowy "MIESZKANIE NA START" rusza w połowie roku.

Ministerstwo szacuje, że w tym roku uda się udzielić 50 tys. preferencyjnych kredytów.Główne założenia:

Kryterium dochodowe brutto:

10 tys. dla singli

18 tys. dla 3-osobowego

23 tys. dla 3-osobowego,

28…— Tomek Narkun (@Tomasz_Narkun) January 4, 2024

The ministry is also considering the introduction of income limits to which subsidies will be payable, and they are planned to be set at 10,000 zloty a month for one-person households, 18,000 zloty for two-person households up to 33,000 zloty a month for households of five people or more.

The loan instalment subsidies are to apply, as with the previous programme, for 10 years.

Poland has for years been faced with a lack of housing, with some estimates pointing to a shortage of as many as 4 million units. The problems are particularly acute for young Poles, nearly half of whom live with their parents, Eurostat figures show.

Prices for both buying and renting in Poland have soared, leaving many struggling to afford housing.

But solutions proposed by the two main parties – to subsidies mortgages – repeat demand-side solutions that have failed in the past, writes @WojciechKosc https://t.co/I0DUlOEn2h

— Notes from Poland 🇵🇱 (@notesfrompoland) March 31, 2023

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Correction: this article has been corrected to remove the total value of mortgage applications in December, which was not reported by BIK.

Main image credit: Siarhei Palishchuk/Unsplash

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.