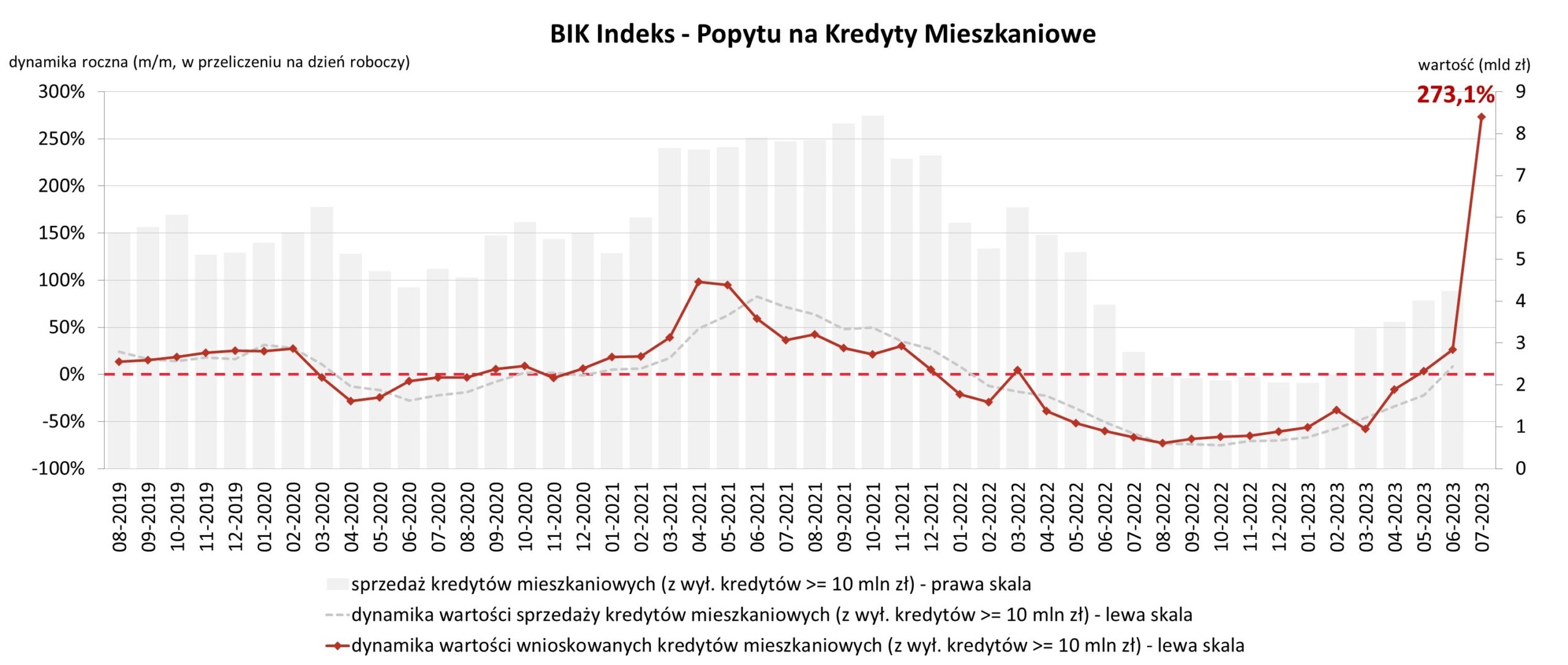

In July, the number of people filing home loan applications in Poland rose three-fold year on year and almost doubled compared to a month earlier, following the launch of a programme of government subsidies for first-time buyers.

Figures released last week by the Credit Information Bureau (BIK) show that a total of 43,470 potential borrowers applied for a home loan in July 2023, compared to 14,100 a year earlier, an increase of 208.3%. Month-on-month, the number of mortgage applicants increased by 97.5%.

Meanwhile, the value of home loan applications rose by 273.1% year on year to over 8 billion zloty (€1.8 billion) in July, reaching a historical high. BIK pinned the surge in demand on, among other factors, the government’s “2% Safe Credit” programme, launched last month, which provides borrowers with a stable mortgage rate of 2% for a period of 10 years, with differences compared to market interest rates covered by the state.

Source: BIK

BIK’s chief economist, Waldemar Rogowski, estimates that around 60% of the people that applied for a mortgage in July are eligible for the government programme by fitting the criteria of being under the age of 45, having no previous home loan and are applying for a loan of up to a maximum of 600,000 zloty.

Rogowski also noted that the value of home loan applications was boosted by rising house prices, which adjusted to the limits imposed by the programme. To benefit from the programme, a single person cannot buy a property more expensive than 700,000 zloty and a married couple 800,000 zloty.

He also indicated that the high increase in the value of loan applications could be a result of a low base effect, following record-low demand last year.

“In part, the increase in demand for home loans is due to improved sentiment towards home loans among potential borrowers who, for formal reasons, cannot be beneficiaries of the programme, but whose capacity to take on a loan has increased,” said Rogowski, adding that consumer capacity to take on more credit was probably boosted by rising wages.

Prices for both buying and renting in Poland have soared, leaving many struggling to afford housing.

But solutions proposed by the two main parties – to subsidies mortgages – repeat demand-side solutions that have failed in the past, writes @WojciechKosc https://t.co/I0DUlOEn2h

— Notes from Poland 🇵🇱 (@notesfrompoland) March 31, 2023

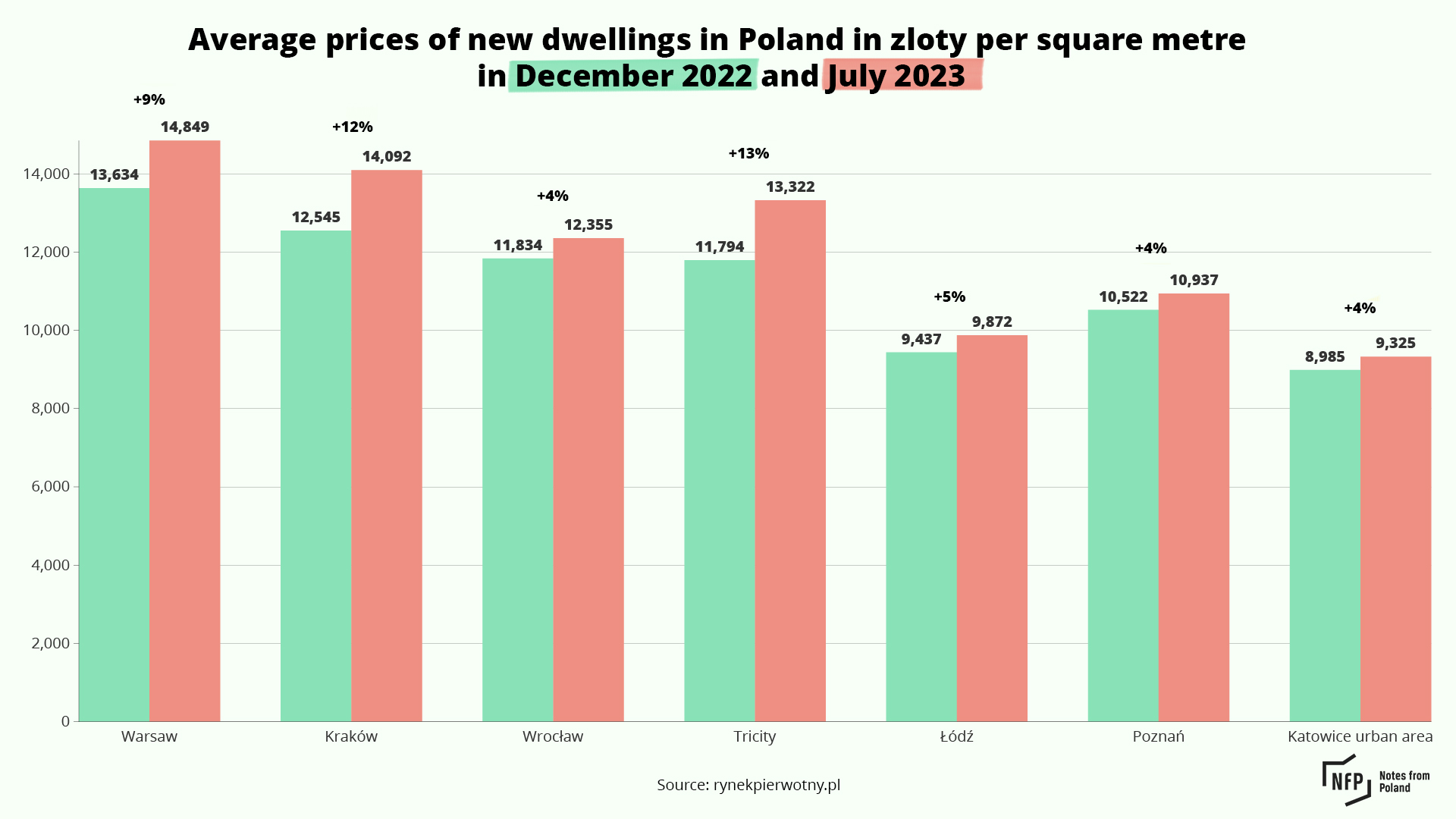

Experts attribute the price increase to the government’s subsidy programme, which already started to boost demand in December last year after the scheme was announced.

According to primary market property website Rynek Pierwotny between December and July, apartment prices in the seven largest Polish agglomerations rose from 4% in Wrocław, Poznań and the Katowice urban area, to 13% in the coastal Tricity (Gdańsk, Sopot, Gdynia).

In July, a square metre of new property cost, on average, the most in Warsaw, 14,849 zloty, and the least in Katowice and surrounding cities, 9,325 zloty.

“Between December 2022 and July 2023, the offer of units in the capital shrank by as much as 29%,” said Marek Wielgo Rynek Pierwotny’s expert.

Poland has faced a housing shortage, which pushed prices up, for a long time, with some estimates pointing to a shortage of as many as 4 million units. Shortages are particularly acute for young Poles, nearly half of whom live with their parents, Eurostat figures show.

Housing affordability has also caught the attention of other major political parties in Poland as they compete for votes ahead of this autumn’s elections. Opposition party Civic Platform (PO), similarly to the ruling Law and Justice (PiS) party, has proposed a scheme whereby the state would subsidise mortgages for first-time buyers.

These proposals and the 2% mortgage programme have been criticised by The Left (Lewica), which argues that increasing demand without boosting supply will simply further raise prices. It has instead proposed to build 300,000 new social housing units over the next four-year parliamentary term.

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: StockSnap / Pixabay

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.