Poland’s development bank BGK cancelled its bond auction that was due on Monday after yields rose sharply, pushing up the cost of debt for the state.

The proceeds were to be allocated, among other things, to the Armed Forces Support Fund at a time when Poland is seeking to increase defence spending following Russia’s invasion of neighbouring Ukraine.

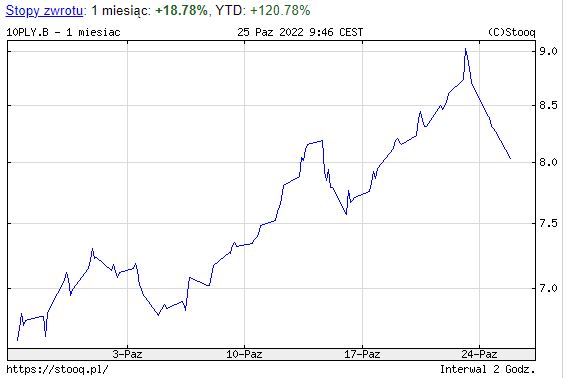

The decision came on Friday, when Poland’s 10-year bond yields exceeded 9% for the first time in more than 20 years, as investors began to demand a higher risk premium in the face of accelerating inflation, the threat of losing billions in EU funds, and the central bank’s surprise decision not to raise interest rates in October.

Polish 10-year bond yields over the month. Source: stooq.pl

On Thursday, just before Polish yields reached their peak, Bloomberg reported that they were rising at the fastest rate in the world. Analysts at Pekao bank pointed out that 10-year bond yields had risen by more than 300 basis points over the month.

“A feverish search is underway for the level at which investors interested in Polish securities will appear,” they said.

BNP Paribas analyst Wojciech Stępień, quoted by Bloomberg, said that “things have gotten crazy” and the central bank’s October decision not to raise interest rates despite surging inflation “was the straw that broke the camel’s back”.

“Loose fiscal policy together with loose monetary policy is the worst combination,” said Viktor Szabo, a London-based money manager at Abrdn Plc, also quoted by Bloomberg. “Poland’s policy mix is absolutely inappropriate for the current environment, bad for markets, bad for inflation.”

Rentowność polskiej 10-latki przebiła 9%, w miesiąc wzrosła o ponad 300 pb (!). Trwają gorączkowe poszukiwania poziomu, przy którym pojawią się inwestorzy zainteresowani polskimi papierami. pic.twitter.com/7qMmlQMIZr

— Analizy Pekao (@Pekao_Analizy) October 21, 2022

In an interview with financial news service Money.pl, Piotr Kuczyński, an analyst from investment firm Xelion, also pointed to the current conflict within the Monetary Policy Council and the risk of Poland losing out on EU funds due to rule-of-law concerns.

“This would be a massive hit to our economy, as we are talking about more than 500 billion zloty. This element has a very big impact on the rising yield rates on our government bonds,” Kuczyński said.

Yields have since fallen after Poland’s Prime Minister Mateusz Morawiecki sought to reassure investors concerned about the lack of a firm response to inflation, which is at a 25-year high. On Saturday he said that national fiscal policy “will aim to bring inflation under control”, pledging to tighten expansive fiscal policy.

Poland's central bank today decided to keep its main interest rate at 6.75%, the first time in a year it hasn't raised the cost of borrowing

The decision defied the forecasts of most economists, who had predicted a further rise after inflation reached a new 25-year high of 17.2% pic.twitter.com/asNCTKA5xF

— Notes from Poland 🇵🇱 (@notesfrompoland) October 5, 2022

“In domestic fiscal policy, we will aim to tighten it in the near term. We are not planning any further spending beyond that already budgeted,” said Morawiecki.

“We will approach… attracting capital from outside accordingly. I am already in contact with many financial institutions from many countries around the world to stimulate interest in Polish debt. I am sure that after this temporary turmoil… we will be able to bring calm to the financial markets,” he added when asked about the cancelled tender.

News of the cancellation of the bond auction to finance Poland’s military purchases came at a time when the country is seeking to increase defence spending in 2023 above 3% of its GDP from 2.4% this year, amid the ongoing war across its eastern border.

“Peace has a price and we must stop fooling ourselves into thinking that we will be safe by not investing in defence, which is why Poland will contribute 3% of GDP to defence,” said Morawiecki on Monday, during a visit to Berlin.

🇩🇪 Premier @MorawieckiM w #Berlin: Pokój ma swoją cenę i musimy przestać się oszukiwać, że będziemy bezpieczni nie inwestując w obronność, dlatego Polska przekaże 3% PKB na obronę.

— Kancelaria Premiera (@PremierRP) October 25, 2022

Although Kuczyński said he was “not surprised” that BGK cancelled the auction and added that “if I were them, if I wasn’t desperate, I wouldn’t borrow either when yields are at such levels,” the opposition said that this situation shows the frailty of financing defence with debt.

“The model of extra-budgetary modernisation of the army adopted a year ago is falling apart, and the defence ministry is buying without a plan and apparently without money,” tweeted former defence minister Tomasz Siemoniak, now deputy leader of the Civic Platform (PO), the largest opposition party.

Przetarg na zakup obligacji finansujących Fundusz Wsparcia Sił Zbrojnych odwołany – koszty spłaty stają się rekordowe. Model pozabudżetowej modernizacji wojska przyjęty rok temu się sypie, a MON kupuje bez planu i jak widać bez pieniędzy. Tylko byle więcej konferencji prasowych. pic.twitter.com/gabTu7c5PK

— Tomasz Siemoniak (@TomaszSiemoniak) October 22, 2022

Main photo credit: Nicholas Cappello / Unsplash

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.