Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Poland’s parliament has approved a proposal by the government to increase corporate income tax (CIT) for banks. The rate would rise from 19% to 30% next year, before being lowered to 23% by 2028.

The finance ministry says the measures are a form of “social justice” given banks’ high profits during a recent period of high interest rates. However, the banking sector has sharply criticised the move, calling it discriminatory.

While the tax rise was pushed through by the government’s majority in parliament, the right-wing opposition voted against it. It remains possible that President Karol Nawrocki, who is aligned with the opposition and has expressed opposition to tax rises, will veto the legislation.

Banki zapłacą wyższy podatek CIT. Sejm znowelizował ustawę o podatku dochodowym od osób prawnych i ustawę o podatku od niektórych instytucji finansowych. pic.twitter.com/cgEmBCYJSb

— Sejm RP🇵🇱 (@KancelariaSejmu) October 17, 2025

Under the proposed law, the CIT rate for banks will rise to 30% in 2026 before falling to 26% in 2027 and 23% in 2028, then remaining at that level.

Financial startups with annual revenues below €2 million will see their rate jump from 9% now to 20% next year, dropping to 16% in 2027 and a final level of 13% in 2028.

Meanwhile, the banking tax, which is levied on banks’ assets, rather than income, will be reduced from its current rate of 0.0366% to 0.0329% in 2027 and 2028 in 0.0293%.

The finance ministry estimates that, overall, the reform will bring in an additional 6.6 billion zloty (€472 million) in 2026, 4.7 billion in 2027, and up to 2 billion zloty in subsequent years.

Defending the plans last month, the ministry argued that Polish banks’ profits have been exceeding the EU average and that the sector has benefited from a recent “high-interest rate environment”.

Amid soaring inflation in 2022 and 2023, the central bank raised Poland’s benchmark interest rate to 5.7%. Only in May this year did it begin to lower the rate, which remains at 4.5%.

“Social justice principles require that in situations of excessive profits resulting from macroeconomic and geopolitical conditions, entities generating them should contribute to a greater extent to the costs associated with such a situation,” wrote the ministry.

Warsaw also needs the extra funds after the European Union placed Poland under its excessive deficit procedure, following a sharp rise in public borrowing. The country’s budget deficit is projected at 271.7 billion zloty next year, or 6.5% of GDP.

Poland’s central bank has cut its benchmark interest rate by 25 basis points to 4.5%, with the bank's Monetary Policy Council citing "improvement in the inflation outlook".

It is the fourth time since May that the rate has been cut, amid slowing inflation pic.twitter.com/s2puk5XbP7

— Notes from Poland 🇵🇱 (@notesfrompoland) October 8, 2025

However, the banking industry has strongly criticised the plans, warning that the new tax burden could weaken the sector’s ability to support economic growth.

“Any reduction in profits indirectly affects Poles, as it affects their pensions and savings,” Adam Marciniak, CEO of VeloBank, told Business Insider Polska.

A legal opinion commissioned by the Polish Bank Association (ZBP) from Ryszard Piotrowski, a professor of constitutional law at the University of Warsaw, also argues the proposed law violates the constitution’s guarantee of equality before the law.

Sejm podwyższa podatek dla banków. Zdaniem profesora Piotrowskiego projekt narusza trzy zasady ➡️ https://t.co/Dl45cOlsY5 pic.twitter.com/wN9nIkpdz7

— Business Insider Polska 🇵🇱 (@BIPolska) October 17, 2025

But deputy finance minister Jarosław Neneman rejected that argument, saying “banks are a specific form of business” that, for example, do not pay VAT, unlike other businesses.

Dorota Marek, an MP from the centrist Civic Platform (PO), Poland’s main ruling party, also defended the plans. “It’s not about placing a permanent burden on the banking sector, but about involving it in solidarity in financing the state’s security during the crisis,” she said.

Marek noted that similar levies exist elsewhere in the European Union, including in Spain and Italy.

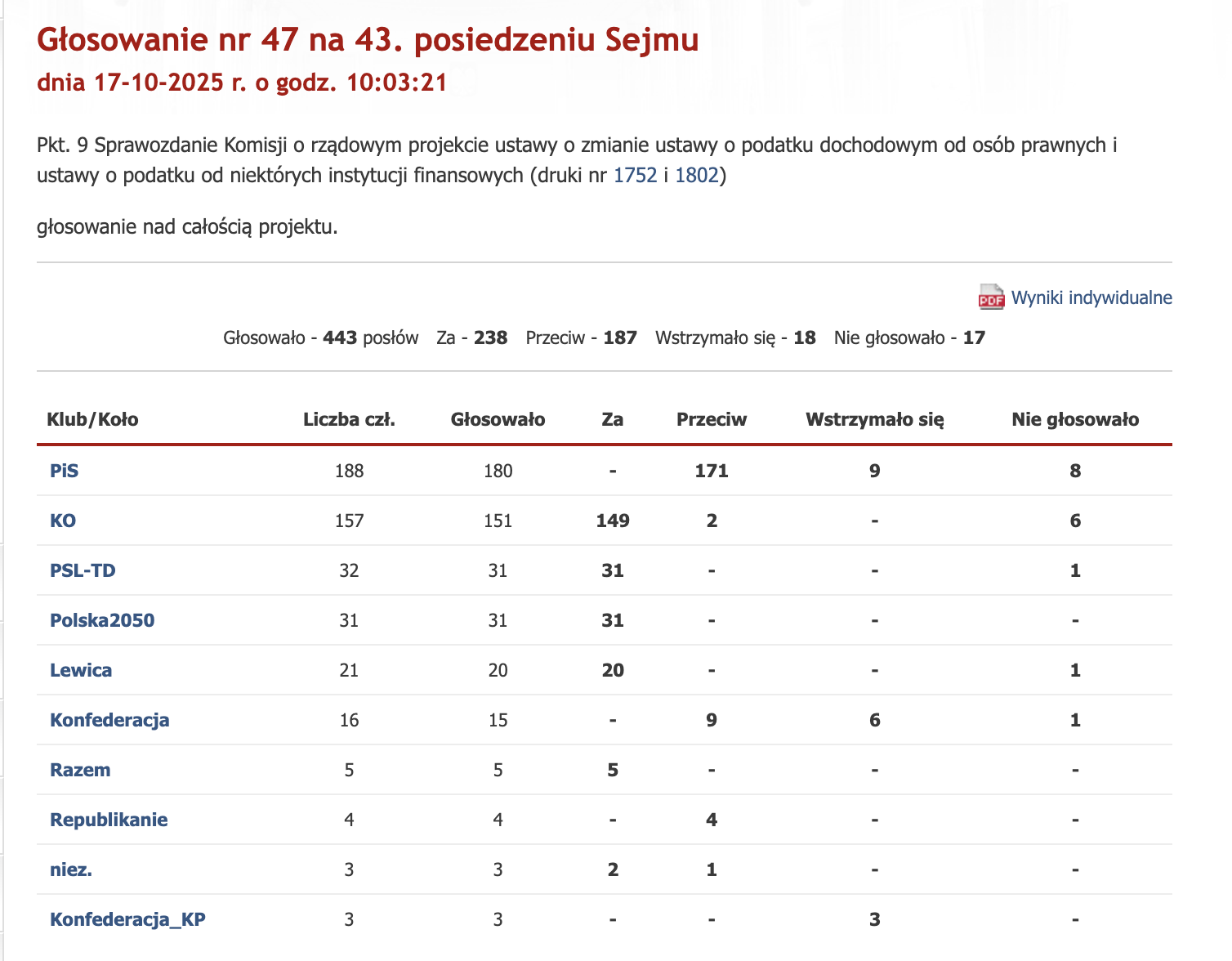

When the proposal came before the Sejm, the more powerful lower house of parliament, on Friday, a majority of 238 MPs, mostly from the ruling coalition, which ranges from left to centre right, voted in favour. There were 187 voted against, mainly from the right-wing opposition.

How MPs from parliamentary caucuses voted on the bank tax bill (za = for, przeciw = against, wstzymało się = abstained, nie głosowało = did not vote)

The bill now passes to the upper-house Senate – which can delay but not block it – then moves to the president, who can sign it into law, veto it, or send it to the constitutional court for assessment.

Nawrocki is aligned with the opposition and, during his election campaign this year, pledged to oppose any tax increases.

However, Wirtualna Polska, a leading news website, reported, citing sources, that the president may ultimately approve the legislation. “In this case, we’re talking about a tax increase for a sector that records record, multi-billion profits,” said a source close to the president.

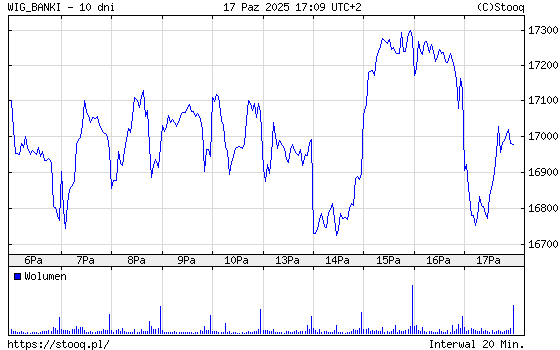

The Warsaw Stock Exchange’s index of bank shares fell around 2.6% on Friday morning but recovered to finish the day less than 1% down on Thursday.

The Warsaw Stock Exchange’s index of bank shares between 6 and 17 November (source: stooq.pl)

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Rakoon/Wikimedia Commons (under public domain)

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.