Keep our news free from ads and paywalls by making a donation to support our work!

Notes from Poland is run by a small editorial team and is published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

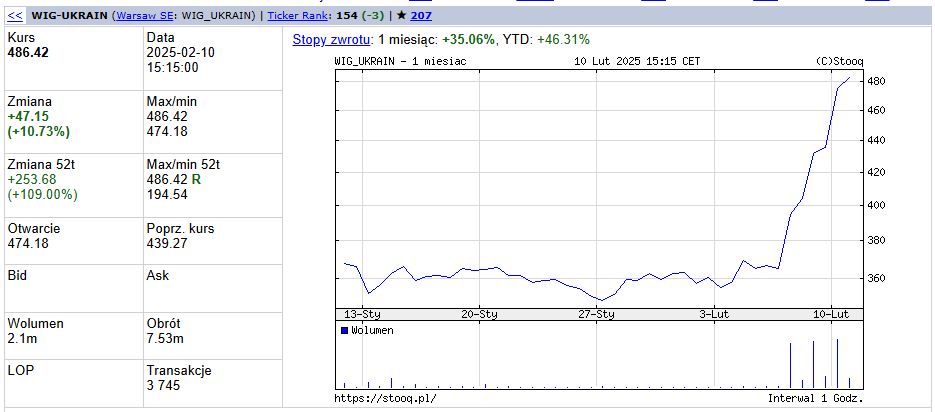

The share prices of Ukrainian companies listed on the Warsaw Stock Exchange (GPW) have surged by nearly 35% over the past week, reaching levels last seen before Russia’s 2022 invasion, with analysts suggesting that investors are betting on a potential US-brokered peace plan.

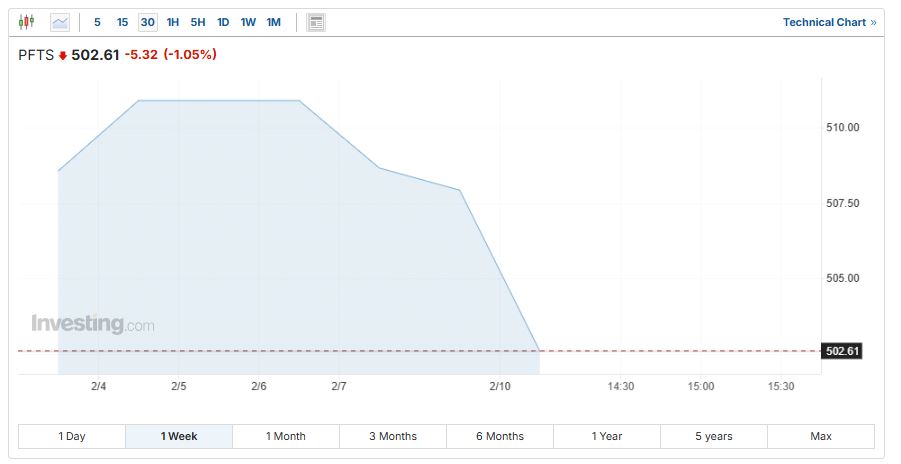

However, the gains of the six Ukrainian companies listed on the GPW’s WIG-Ukraine index have not been matched by the main index on Ukraine’s own stock exchange, the PFTS, which has declined by 1.6% since last week.

According to Polish business newspaper Puls Biznesu, investors in the GPW are increasingly factoring in a postwar reconstruction effort in Ukrainian-controlled territories, along with possible negotiations on Ukraine’s accession to the European Union.

Sentiment has improved after Trump claimed his team has made progress in negotiations and has been in contact with Russian President Vladimir Putin. Since taking office in January, he has pledged to secure a peace deal within his first 100 days.

On Wednesday last week, Bloomberg reported that Donald Trump’s special representative for Ukraine and Russia, Keith Kellogg, will present the plan to allies, but not publicly, during a conference in Munich on 14-16 February.

Kellogg, in an interview with Newsmax, dismissed reports that he would present a peace plan during the conference but indicated that he intended to hold numerous talks with European leaders in Munich and report back to Trump on his return.

Despite this, Ukrainian shares on the GPW started to rise on Thursday morning last week, gaining 34.79% by Tuesday morning. Since the beginning of the year, the WIG-Ukraine has increased by 46.31%, according to data from financial information service Stooq.

The WIG-Ukraine index is comprised of GPW-listed companies whose registered office or head office is located in Ukraine or whose operations are conducted to the greatest extent in that country.

It includes five agricultural companies – IMC, Agroton and KSG Agro, Astra Holding and Milkland – as well as mining firm Coal Energy.

The postwar reconstruction of Ukraine will bring Poland up to 190 billion zloty (€38.9bn), equivalent to around 3.8% of its GDP, finds a report

Poland's recent experience of economic integration with the EU makes it well placed to help, note the analysts https://t.co/kBZyGAJ72c

— Notes from Poland 🇵🇱 (@notesfrompoland) October 7, 2022

Ukrainian companies listed on other global stock exchanges have also seen their share prices rise. MHP, the largest Ukrainian producer and exporter of poultry and crops, which is listed on the London Stock Exchange (LSE), has risen by just over 13% since last Thursday.

Meanwhile, IT company EPAM Systems, listed on the New York Stock Exchange (NYSE), rose by 5% from Wednesday close to Friday evening, data from Investing.com show. The company has lost some of its gains this week, but is still 2.4% above Wednesday evening’s levels.

This enthusiasm, however, did not translate into gains on Ukraine’s own stock market, where the benchmark PFTS index has fallen by 1.57% since Thursday, data from Investing.com show.

Enthusiasm over a potential peace plan, however, did appear to boost Polish companies on the GPW, as analysts see this as a key opportunity for not only Ukrainian firms but also Polish companies with a strong presence in the Ukrainian market.

“This is especially true for construction companies and manufacturers of building materials with experience in Ukraine,” Jakub Szkopek, an analyst at Erste Securities, told Puls Biznesu.

He cited Grupa Kęty, a producer of aluminium components, and construction company Budimex as businesses that stand to benefit from Ukraine’s reconstruction. Since Thursday, both companies recorded rises in their stock prices, with Grupa Kęty up by 5.9% and Budimex by 10.45%,

The WIG20, an index composed of the 20 largest Polish companies on the GPW, has also been rising since Thursday, gaining over 5%. Since the begining of the year, the WIG20 has risen by over 15%.

It received an additional boost on Monday from Prime Minister Donald Tusk’s announcement – during a speech at the GWP – of a new economic development plan for Poland. This helped the Polish blue-chip index surpass its previous all-time high.

The plan focuses on six key areas: investment in science and research, energy transition, modern technologies, port development and railway modernisation, a dynamic capital market, and business cooperation.

However, critics noted that Tusk’s announcement contained a lack of specific new policies that his government intends to pursue in those areas.

Prime Minister @donaldtusk has outlined an economic plan that he says will help Poland move from "dreaming of catching up with the most developed countries" to instead realising it is "possible to overtake those who until recently looked down on us" https://t.co/WKLw0m0UJh

— Notes from Poland 🇵🇱 (@notesfrompoland) February 10, 2025

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Freepik

Alicja Ptak is deputy editor-in-chief of Notes from Poland and a multimedia journalist. She has written for Clean Energy Wire and The Times, and she hosts her own podcast, The Warsaw Wire, on Poland’s economy and energy sector. She previously worked for Reuters.